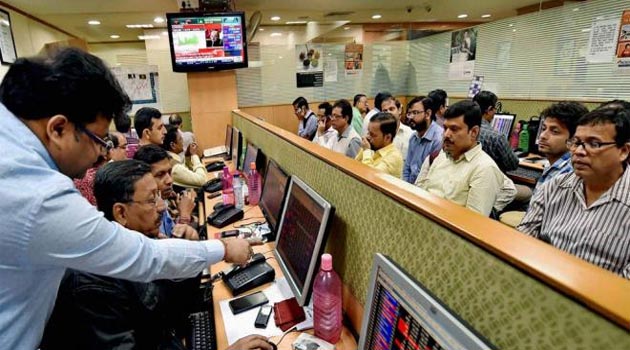

Soared markets effect MF sales

BSE’s 30-share Sensex touched a record high of 36,443.98 on 29 January 2018, and is down 6.68% ever since as turmoil in global equity markets wreaked havoc.

These stocks were ICICI Bank Ltd, Housing Development Finance Corp. Ltd (HDFC), IndusInd Bank Ltd, HDFC Standard Life Insurance Co. Ltd and Axis Bank Ltd.

Mutual funds sold a total of Rs1,191.36 crore of ICICI Bank shares in January, while they offloaded Rs778.15 crore and Rs658.13 crore of HDFC and IndusInd Bank Ltd shares, respectively.

I think given the run-up that has happened, it looks like there is profit booking. Positions have been trimmed due to high valuations.

“Cyclicals are still the most preferred sectors. We have not seen any significant reduction in the interest there. What we are recently seeing though is rising interest in consumer-oriented stocks,” said Vidya Bala, head of mutual fund research at Fundsindia.com.

“Gradual revival of rural demand is seen, and that is helping the consumer-focused plays-be it discretionaries, FMCG, autos etc,” added Bala.

Others seem to agree.

“I would say a little bit of profit booking due to market rally and relatively higher valuations, and moving to certain stocks where valuations were comfortable,” said Gopal Agrawal, chief investment officer (equities) at Tata Asset Management Co Ltd.

“This is also a typical feature of the earnings season,” added Agrawal.

Among the most bought large-cap stocks, telecommunications provider Bharti Airtel Ltd was at the top as mutual funds bought Rs1,392.25 of its shares last month. The stock declined nearly 17% in January.

Power Grid Corp. of India Ltd was the second-most bought stock with mutual funds shoring up Rs981.99 crore of the company’s shares last month.