RBI warns using forex limits to trade in dollars

The Reserve Bank of India (RBI) has cautioned against the use of its liberalised remittance scheme (LRS), which allows individuals to send up to $250,000 abroad annually, to trade in forex platforms. RBI’s caution comes at a time when remittances under the scheme are picking up. They reached almost $2 billion a month in August and September 2021.

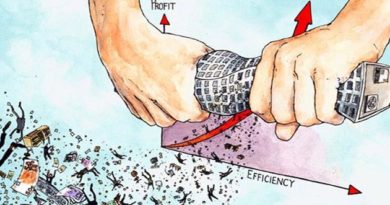

The central bank has said that there are unauthorised electronic trading platforms (ETPs) that have engaged agents to lure people to undertake forex trading with promises of ‘exorbitant returns’. “Further, there have been reports of frauds committed by such unauthorised ETPs / portals and many residents losing money through such trading / schemes,” the central bank said. It added that these schemes are being pushed through social media platforms, search engines, gaming apps and over-the-top platforms.

The RBI has said that while permitted forex transactions can be executed electronically, they should be undertaken only on ETPs authorised for the purpose by the central bank or on recognised stock exchanges (NSE, BSE and Metropolitan Stock Exchange of India).