India’s Sovereign Bond Market: Opportunities to re-evolve

Bank treasuries in India play a pivotal role in the sovereign bond market, actively trading in a segment that dominates the country’s financial landscape. Sovereign bonds, endowed with Statutory Liquidity Ratio (SLR) status, are indispensable for institutional portfolios. These instruments provide banks with a secure avenue to deploy surplus funds while reaping significant coupon interest—a reliable revenue stream regardless of prevailing interest rate trends. Furthermore, their insulation from volatile market-based valuations enhances their appeal, making them a cornerstone for financial stability.

The sovereign bond market boasts daily trading volumes of approximately Rs. 50,000 crores, underlining its scale and liquidity. In the Indian financial ecosystem, it is the ‘elephant in the room’—overshadowing higher-yield but riskier securities. Its intrinsic role in funding economic growth has cemented its dominance, a status achieved through a century-long evolution and adaptation. However, the bond market today is at a crossroads, calling for innovation, depth, and increased retail participation to sustain its momentum.

Evolution of Public Debt in India: A Historical Perspective

The Pre-Independence Era

In the 18th century, the financial needs of Indian princely states were primarily met by indigenous bankers and financiers, who provided loans and credit for governance and military campaigns. The concept of borrowing from the public was introduced by the East India Company to finance its campaigns in South India, notably during the Anglo-French wars. Over time, this borrowing evolved into what is known today as public debt, where the government borrows money from the public or financial institutions. Towards the late 18th century, the East India Company sought to establish government banks to raise funds more effectively. These banks were precursors to central banks and aimed to manage the Company’s debt more efficiently by providing both short-term and long-term financial resources on favourable terms. The establishment of such banks laid the foundation for modern debt management systems.

Up to 1867, the public debt borrowing primarily supported military campaigns and territorial expansion, reflecting the needs of the colonial administration. Between 1867–1916, public debt was increasingly used to fund railway construction, irrigation canals, and other public works. This shift marked the beginning of borrowing for capital formation and long-term development. During world war I, public debt saw a sharp rise due to India’s contributions to the British war effort. Provincial borrowing was allowed for the first time under the Government of India Act, 1919, enabling local governments to float loans. The rise accentuated during the World War II, with efforts to absorb wartime incomes through borrowing to curb inflation.

Post-Independence Developments

Post-Independence and Partition, economic instability seeped in as reconstruction efforts heightened often resulting in unmet budgetary targets. The period from 1951 to 1985 saw the five-year plan borrowing in a systematic manner, wherein efforts were made to align government security interest rates with market rates following the recommendations of the Chakraborti Committee.

Post liberalization of 1991, comprehensive reforms were undertaken in the government securities market, including introduction of innovative instruments like zero-coupon bonds, floating rate bonds, and capital-indexed bonds. Enhancement of transparency through auction mechanism for bond issuance, standardization in valuation of these securities and development of secondary market led to growth in the bond market. Entities like the Securities Trading Corporation of India was established to deepen the market. In May 1994, now known as STCI Finance Limited was promoted by RBI with the main objective of fostering an active secondary market in Government of India Securities and Public Sector bonds. RBI owned a majority stake of 50.18% in the paid-up share capital of the company. In 1996, the Company was accredited as the first Primary Dealer in India. As one of the leading Primary Dealers in the country, the Company was a market maker in government securities, corporate bonds and money market instruments. Its other lines of activities included trading in interest rate swaps and trading in equity – cash & derivatives segment. The Company enjoyed a successful history of achieving profits during consecutive years spanning a decade. RBI divested its entire shareholding in STCI in two stages.

Since, the turn of the century, the sovereign bond market matured and expanded further. The introduction of the Negotiated Dealing System (NDS) in 2002 facilitated electronic trading and reporting. The Clearing Corporation of India Limited (CCIL) was established for settlement and risk management. The shift to floating-rate instruments and longer maturity tenures diversified the market and the gradual opening to foreign institutional investors (FIIs) increased capital flows and market depth. Innovative instruments such as the Inflation-Indexed Bonds of 2013, was designed to protect investors from inflation risks, as these bonds linked returns to the Consumer Price Index (CPI). Sovereign Gold Bond, another government security issued by the Reserve Bank of India (RBI) on behalf of the Government of India was introduced in the year 2015. It was denominated in grams of gold and was linked to the price of gold in India. In the year 2021, the once highly institutionalized participation was opened for individuals through introduction of the RBI Retail Direct Scheme. RBI Retail Direct Scheme, launched in November 2021, gives access to individual investors to maintain gilt accounts with RBI and invest in government securities. The Scheme enables investors to buy securities in primary auctions as well as buy/sell securities through the NDS-OM platform.

Recent Innovations

In 2023, aligning with India’s ambitious Nationally Determined Contribution (NDC) and its commitment to decoupling economic growth from greenhouse gas emissions, the Government of India issued Sovereign Green Bonds. On January 25, 2023, the Ministry of Finance formally joined the Sovereign Green Bonds Club by pricing an Rs. 80 billion issuances. The proceeds from these bonds were allocated to initiatives such as grid-scale solar and wind energy, decentralized solar solutions like solar water pumps for agriculture, green hydrogen production, metro rail projects, and afforestation efforts.

Dominance of Sovereign Bonds in Institutional Portfolios

This journey of more than a century prolonged period has seen the depth of the sovereign bond market gravitating further so much that close to 80% of the following top PSU Bank’s domestic investments are parked in these government backed securities.

| Q2FY2025 | Rs. In Crores | |||||

| SBI | BOB | PNB | UBI | Canara | IOB | |

| Domestic Investment | 15,98,761 | 3,60,244 | 4,70,391 | 3,57,175 | 3,75,568 | 1,03,128 |

| SLR | 13,10,905 | 3,00,180 | 3,48,490 | 2,84,423 | 3,26,523 | 78,218 |

| SLR (%) | 82% | 83% | 74% | 80% | 87% | 76% |

The government securities comprising of Central Government Bonds, State Development Loans, Treasury Bills, Sovereign Gold and Green Bond have been used as benchmark for pricing other similar financial instruments. The Government Securities issuance announced in the budget document every year helps gauge India’s fiscal discipline. This in turn is used by the international market pandits to assign the country’s credit rating.

Regular and transparent issuances of government securities signal fiscal discipline, while benchmark yields, such as those on 10-year bonds, serve as key indicators for credit rating agencies. Low yields demonstrate investor confidence and effective fiscal management, while high yields can highlight fiscal strain, influencing a country’s creditworthiness. At present, Standard & Poor’s credit rating for India stands at BBB- with positive outlook. Moody’s credit rating for India was last set at Baa3 with stable outlook. DBRS’ credit rating for India was last reported at BBB (low) with positive outlook. In general, these credit ratings are used by sovereign wealth funds, pension funds and other investors to gauge the credit worthiness of India thus having a significant impact on the country’s borrowing costs. A robust bond market anchored by sound fiscal policies lowers borrowing costs, enhances global investor confidence, and strengthens a nation’s creditworthiness, fostering long-term economic stability and growth.

Yields, Market Sentiments, and Benchmarks

The borrowing cost of the government is the coupon at which these government securities are issued through auctions conducted by governments banker, the Reserve Bank of India. Different maturity paper attracts differential coupon. This financial year the issuances have ranged from 3 years to 50 years, with coupon yield ranging from 6.64% to 7.34%. These coupons are the borrowing cost of the government. Hence, during benign interest rate scenario, government tends to borrow more to avail the benefit of low interest cost. This issuance forms part of the primary market.

| New Issuances FY2025 | ||

| New GS 2034 7.10%

|

New GS 2039 7.23%

|

New GS 2064 7.34%

|

| New GS 2027 7.02%

|

New GS 2029 7.04%

|

New GS 2031 7.02%

|

| New GS 2054 7.09%

|

New GS 2034 6.79%

|

New GS 2039 6.92%

|

| New GS 2074 7.09%

|

New GS 2027 6.64%

|

New GS 2029 6.75%

|

| New GS 2031 6.79%

|

GOI SGrB 2034 6.79% | GOI SGrB 2034 6.90% |

Once, these securities make way into the hands of primary dealers, who are underwriters to government issuances, the market demand decides the premium or discount at which these securities trade. Usually, government issues, securities to the tune of Rs.1 lakh crore in a particular tenor, hence for example, New GS 2031 which got issued at 6.79% on the day of its first issuance, gets re-issued as 6.79%GS2031 in subsequent auctions till it reaches the quantum of Rs.1 Lakh crore. As long as the quantum of issuance remains unexhausted, the bond market trades in such securities actively. As the issuance reaches exhaustion limit, the number of trades decline placing such securities in the sparsely traded or untraded category. They are also removed from the margin eligibility category by CCIL and RBI and replaced by actively traded security. Hence, investors who plan to hold such securities till maturity may enjoy half yearly coupon payments, but traders need to exit by booking profits or cutting losses if it remains in the trading parlance of the market. When a security is traded rarely, it is not possible to find a desirable exit and may lead to distressed selling or locking funds in holdings till maturity. The government comes with conversion or switch auctions at times to ease the pressure of redemption and may provide investors with an exit option, but the possibilities are not coincident with one’s holdings.

The most traded security is the 10-year benchmark paper. The yield of the 10-year G-sec reflects market sentiment regarding economic conditions, inflation expectations, and monetary policy. A rising yield often signals expectations of higher inflation or tighter monetary policy, while a falling yield suggests the opposite. It is widely used by institutional investors, such as banks, mutual funds, and insurance companies, as a benchmark for portfolio allocation and performance. The 10-year G-sec yield is also used to price long-term bonds and loans. It is a critical determinant for foreign portfolio investors (FPIs) when deciding on investments in Indian debt markets. A favourable yield spread compared to other countries attracts foreign capital. The 10-year G-sec benchmark paper is a cornerstone of India’s financial markets, influencing investment decisions, policymaking, and the broader economic environment. Looking at the historical movement, India has seen its 10-year benchmark rate falling from 12.75% levels in 1998 to the 6.89% levels of 2025 marking significant improvement in the economic condition of the country in the past two decades. There has been an influx of foreign funding which has created a demand for sovereign bonds which has also lowered the borrowing cost for the government.

Global Integration and Future Opportunities

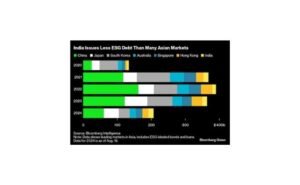

The recent addition of India’s sovereign bonds in the JP Morgan and Bloomberg’s Global Bond Index has added another feather in the cap for India. The influx of close to $21 billion has eased the yields from above 7.00% levels to 6.80% levels. Further, issuance of sovereign green bonds is changing the landscape of government bonds. We may see a steady transition of all government bonds turning green. However, India’s vulnerability in climate risk index is making this transitionary path look quite challenging. Comparing the issuances of Asian Market along, we find India lagging its Eastern counterparts. To retain the interest in the sovereign bond market India needs to realize that the eventual transition must be adopted proactively to stay ahead of the curve and maintain its elephant-like stature in the bond market. With India’s commitment towards meeting its net zero target, we may see the issuances transition rapidly in coming years as immense potential lays embedded in India’s Sovereign Bond Market.

Digital Intervention and Inclusion

What more can we expect in the sovereign bond market space! It is the rise in investor education level and ease of accessibility in these markets through the RBI retail direct app. The digital revolution in India is testimony to the endeavours the country has taken when it comes to financial inclusion. With Banking within the reach of a common man in a remote village, it is now the time for the debt market to make a foray in the retail space. Owing to the sovereign backing and risk-free return, these bonds provide a reliable avenue for individuals to invest their hard-earned money without the risk of losing out on the principal investment is held till the final redemption. The opening up of primary market issuance for retailers may see the growth equivalent to that of India’s equity market in days to come. The bond yields may not only soften reducing the exchequers burden but also open avenue for secondary market trading in the odd lot segment. As of today, a minimum tick size of Rs.5 Crore is traded by institutions and anything lower than the amount falls under the odd lot category with limited takers. Individuals find it difficult to trade on NDSOM’s (Negotiated Dealing System Anonymous Matching) secondary market platform with the same ease as that on the stock exchanges. However, with increasing investor awareness and greater retail participation, the desired liquidity in the odd lot trading segment will get augmented.

The dark horse in the bid to deepen the bond market will be the concern of India’s high fiscal deficit and debt-to-GDP ratio. Sustained high borrowing requirements has the propensity to increase yields and crowd out private investment. Moreover, growing protectionism due to increasing geopolitical tensions may impact foreign investor sentiment and lead to capital outflow and hardening of yields yet once again. What may function as a panacea to these ailments is the rapid technological integration in all occupations including the sovereign bond market. Blockchain and AI technologies could improve transparency and efficiency in bond trading and settlement processes. E-platforms for government securities will enhance accessibility to foreign players as well thereby reducing costs. There is likely to be an increasing focus on issuing longer-tenor bonds to meet the needs of infrastructure financing and pension funds. Beyond traditional bonds, innovative instruments like inflation-linked bonds and municipal bonds may gain traction. Greater regulatory oversight and reforms could bolster trust and attract both domestic and international investors.

Conclusion

India’s sovereign bond market stands at a pivotal juncture. With its elephantine presence in the financial ecosystem, it is both a reflection of economic resilience and a vehicle for future growth. Through strategic reforms and technological integration, it can evolve into a robust, inclusive, and globally competitive market, paving the way for sustainable development and financial innovation. In order to maintain dominance, India must embrace blockchain and AI for efficient bond trading, intrinsically promote retail participation through reforms in trading and investment and most importantly transition swiftly to green bonds in a massive way, aligning with net-zero targets. While challenges such as fiscal pressures and global uncertainties persist, policy measures and structural reforms are expected to support the market’s evolution into a more robust and globally integrated ecosystem.

Authored by:

Neha Nidhi

Chief Manager

Union Learning Academy

Corporate & Treasury

Union Bank of India