Financial Literacy through Financial Education Workshops and Investors Awareness Programs by Regulatory and Professional Bodies

Introduction:

Financial literacy is the knowledge and skill about finance which facilitates the investors to remain one step forward for financial decision making as a part of their personal financial planning. Financial literacy is the ability to understand how money works in the world, how someone earns it, how that person manages it and how he/she invests it for getting higher return. So it is clear that financial literacy is the pillar for making a sound financial plan and planning of personal finances is essential for every individual who may be a potential investor or regular investor. Thus, financial planning and financial literacy both are important for potential investors like school children, college students; or existing investors like- middle income group, office executives etc. Here lies the significance of Investors’ Awareness Programmes which enrich the investors’ knowledge and skill for making a proper plan of their personal finance. At present these Investors’ Awareness Programmes (IAP) and Financial Education Workshops (FEWs) are organised by different professional and regulatory bodies which are very popular in many countries including India.

Investors’ education or awareness programmes are such an initiative which is taken to secure a better financial future for the investors, enhance the financial knowledge, spread financial awareness, reduce the financial risk, identify the utilities and characteristics of different financial products before investment and improve money management skills and financial behaviour of a person. In India, different regulatory and professional bodies like Securities Exchange Board of India (SEBI), Reserve Bank of India (RBI), Ministry of Finance (MOF), Ministry of Corporate Affairs (MOCA), Institute of Company Secretaries of India (ICSI) etc. are arranging these Investors’ Awareness Programmes in all over India. Now, we need to know the success rate of these programmes and how that success can be identified in terms of improved knowledge and perception of the potential as well as existing investors about their personal investment portfolio. This study is mainly focussing on the effectiveness of the Investors’ Awareness Programmes on the investors’ perception of their investment portfolio.

Review of Literature:

- Chen and R. P. Volpe (1998) surveyed 924 college students to show their financial knowledge and relationship between their financial literacy with their financial behaviour. The findings of the study indicated that the college students were financially illiterate and that knowledge gap restricted them from taking sound financial decision.

- Abreu and V. Mendes (2005) suggested that investor’s level of financial education, financial knowledge and information resources on markets and financial products had a significant impact on the decisions taken by them on the portfolio diversification.

- Johnson and M. Sherraden (2006) explored that financial capability depends not only on financial knowledge and skills, but also on the accessibility of financial instruments and institutions. The findings suggested that the combination of financial education and financial institution access may be an effective combination which would lead to financial capability among youth.

- Lusardi and O. S. Mitchell (2007) revealed through their study that many households in United States and other countries were financially illiterate to make saving, investment decisions, retirement planning, mortgages, and other decisions. This study also showed that to curb this financial knowledge gap among people, governments and several non-profit organisations of those countries had undertaken initiatives to enhance financial literacy.

- M. Peng et al. (2007) investigated the impact of personal finance education delivered in high school and college through a web-based survey on the students. The result suggested that there were no significant impact of personal finance education course on the investment knowledge of the students, but financial experiences were found to be positively associated with better investment decisions of the students.

- Cole, T. Sampson, and B. Zia (2009) used a survey data of financial literacy programme on selected unbanked households from India and Indonesia to show that financial literacy is a powerful predictor of demand for financial services. The purpose of the study was to test the relative importance of literacy and price. The findings suggested that financial literacy program has no effect on the financial behaviour of the participants but modest effects of small subsidy payments were there for uneducated and financially illiterate households.

Jennifer Turnham (2010) conducted a survey on 18 focus groups with mostly low-income individuals to explore how community-based organisations might encourage better financial practices, including higher savings rates, among low-income and vulnerable populations. Findings suggested that educating low-income and vulnerable populations about financial concepts is important.

M.F. Sabri and M. McDonald (2010) examined the relationship of savings behaviour and financial problems among college students in Malaysia. A survey had been conducted on the students of 11 colleges and universities in Malaysia. The findings suggested that financial literacy had a significant role in better savings behaviour and negatively related to financial problem of the college students.

Melissa Donohue (2011) identified by his study that financial literacy may not lead directly to financial success without sufficient access to capital. This study also clarified that women or any group of people in United States who had less access to capital face economic barriers and it restricted their financial practices. So this study showed that there were no gender differences in financial knowledge but it was in financial access.

Hmoud Fanash Al Surikhi (2012) contributed towards a clearer understanding of the relationship between women’s level of education and their involvement in financial decision-making. This paper attempted to explore women’s perceptions about their involvement in household financial decision-making. The purpose of this study was to show the role of knowledge in the financial decision process in households.

Cheryl A. Ayers (2012) examined the involvements of the teachers to incorporate economic and personal financial knowledge and skills into their respective curricula in a meaningful, active and collaborative way so that the students can get the maximum financial knowledge and that financial education would lead their financial behaviour.

Hans-Martin von Gaudecker (2013) showed that the largest losses resulting from under diversification were incurred by those households who had invested without any financial advice or had no skills in basic financial operations and concepts. The results suggested that both financial literacy and financial advice from professionals are important for investors to reduce welfare losses from inferior investment strategies.

Puneet Bhushan (2014) Indicated through his study that investment preferences of the salaried individuals of different districts in Himachal Pradesh were towards the traditional and safe financial assets but they are quite reluctant to invest in new-age financial products due to lack of knowledge and information. Overall results suggested that people must be made more aware about new investment opportunities available in the market so that they can get the advantage of higher return with minimum risk.

Research Gap:

It has been observed that the previous research works are mainly focussed on the need and effectiveness of the financial education programmes to the different categories of investors especially to the potential investors like high-school students and college students for improvement in their financial decision and behaviour but no research has been conducted so far in India on the effectiveness of the Investors’ Awareness programmes which is focussing many other categories of existing and potential investors along with school and college students. Thus a comprehensive study on Financial Education Workshops and Investors’ Awareness Programmes conducted by the different regulatory and professional bodies from social audit perspective would be a great contribution in financial literacy.

Objectives of the Study:

Keeping view with the different research gaps, this study intends to concentrate on following objective:

- To analyse the theoretical framework of the social audit.

- To assess the social responsibility of the regulatory and professional bodies in protecting the investors’ interest.

- To evaluate the efficiency and effectiveness of the Financial Education Workshops and Investors Awareness Programs

Research Methodology:

Since the present study is exploratory in nature, both the primary and secondary data are very much essential for this study. Primary data is the backbone of the analysis. Mainly questionnaire survey will have to be done to collect those data relating to different Investors Awareness Programmes and their impact on the different categories of potential and existing investors. Mainly two categories of investors are to be chosen as the sample for the study to justify its objectives such as (1) Potential Investors like School Children, College Students and Home makers and (2) Existing Investors like-Middle Income Group, Retired Persons, Corporate Executives etc.

Discussion and Analysis:

Social auditing, one of the buzz word in modern world, is referred to a process that facilitates society to assess an organisation’s contributions towards society, economy and environment. Social audit helps in narrowing the gap between the mission or vision of any project and the reality. It encourages public hearing to identify and rectify the regulations in public projects. The Right to Information (RTI) Act, after being enacted in the year 2005, made the process of social audit much smoother and thereby it became the ultimate option that assures the common people from being victimised by the unscrupulous people having strong power in the society. Mazddor Kisan Shakti Sangathan (MKSS) in Rajasthan is acknowledged as the first to start the concept of social audit in India in 1990s by fighting corruption in the public works. Recently, Parliamentary Standing Committee had recommended strengthening of comprehensive grievance redressal mechanism on rural development through social audit from the grassroots level by the states. The committee has also expressed its dissatisfaction as only ten states viz. Andhra Pradesh, Chhattisgarh, Gujarat, Karnataka, Mizoram, Sikkim, Telangana, Tamil Nadu, Tripura and Uttar Pradesh have operationalised social audit units as laid down in Social Audit Rules 2011 and states like Madhya Pradesh, Odisha, Manipur, Meghalaya, Rajasthan and Jammu and Kashmir are in the process of doing it.

Important Facts about Social Audit:

- Social audits were first made statutory in Rural Employment Act, 2005 and government also issued the Social Audit Rules in the year 2011.

- Autonomous bodies consisting of government and nongovernment representatives generally supervise social audits.

- The 73rd Amendment of the Constitution empowered the Gram Sabha (s) to conduct Social Audits in addition to other functions.

- The Comptroller and Auditors’ General (CAG) is not empowered to conduct Accounting Audit.

- Social Audit has not been made mandatory by any central policy or regulation.

It is apparent that the elimination of corruption is not the sole objective of Social Audit. Protection of stakeholders is also an important contribution of Social Audit.

Thus, the regulatory and professional institutions have their responsibility towards the investors as a whole. So making the Investors financially aware and protecting their interest is also a social responsibility of those regulatory and professional bodies. Here lies the need of social audit of the regulatory and professional bodies to assess their contributions and initiatives towards spreading Investors’ Awareness.

Regulatory and Profession Bodies in Protecting Investors’ Interest and Financial Literacy:

In addition to their stipulated professional duties the regulatory and professional bodies are voluntarily taking part in protection and education of the common people who are present as well as potential investors. The following are the important roles that social audit plays in respect of protection of investors interest by assessing the performance of the regulatory and professional bodies in this regard:

- These regulatory and professional bodies often utilise investors’ protection funds to conduct various awareness programmes. These funds are generated through public money. Therefore, ensuring proper utilisation of these funds becomes the responsibility of social audit.

- Social audit process ensures the reach of the regulatory and professional bodies in spreading awareness to the people at the remotest part of the country.

- It also looks after the consistent follow up programmes which are very important for effectiveness of IAPs.

- It also ensures participation of people from all sectors of the society in these IAPs.

The scope of social responsibility has been widening and it has become an emerging trend not only for the corporate but for various other entities or institutions. The regulatory bodies in our country, monitoring various activities in micro and macro level on behalf of the Government, are also not out of it.

Major Findings:

Reserve Bank of India (Regulatory Body):

As an apex body of Indian banking sector Reserve Bank of India has taken many initiatives to spread financial literacy all over India throughout the past years since 2011.

- As per the advice of Reserve Bank, banks had set up Financial Literacy and Credit Counselling Centres (FLCCs) in February 2009 to provide free financial literacy, education and credit counselling. Under this scheme, 429 FLCCs were set up till March 2012.

- A nationwide sample survey was being conducted by RBI to judge the efficacy of the scheme and effective functioning of FLCCs in 2012 covering 30 FLCCs spread over 16 states.

- In the year 2012, RBI also had introduced outreach programmes that involve top management of RBI such as Governor, Deputy Governors and Executive Directors who visit villages across the country who encourage banks, financial institutions and local government to boost economic activities by involving rural masses in particular. They interact with the villagers to understand their problems and expectations, at the same time they also tell them about Reserve Bank’s policy initiatives and what they can expect of the Reserve Bank.

- In the year 2013, a National Centre for Financial Education (NCFE) was proposed to be set up as an institutional mechanism to co-ordinate the efforts of all financial sector regulators through a common website on financial education for the country.

Securities Exchange Board of India (Regulatory Body):

- With the aim of spreading financial literacy, SEBI has taken up various programs across the country. The resource person model developed by SEBI has been well appreciated internationally as well as domestically by other regulators and various ministries.

- SEBI launched a financial education drive through Resource Persons (RPs) in June 2010, where teachers and lecturers were trained and empanelled for conducting financial education workshops.

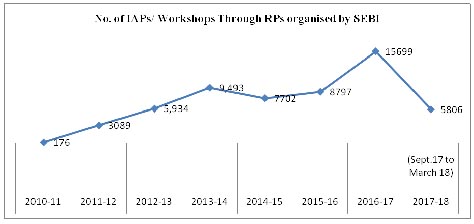

Region wise number of awareness programmes/workshops through resource persons conducted by SEBI is shown in following table and graph:

| Region | 2014-15 | 2015-16

|

2016-17 | 2017-18

(Sept.17 to March 18) |

| HO | 585 | 818 | 1412 | 1282 |

| ERO | 1574 | 1639 | 2183 | 711 |

| NRO | 2112 | 2311 | 7275 | 3154 |

| WRO | 1906 | 1669 | 2329 | 325 |

| SRO | 1525 | 2360 | 2500 | 334 |

| Total | 7702 | 8797 | 15699 | 5806 |

Source: Annual Reports of SEBI

The number of awareness programmes or workshops organised by SEBI through RPs since 2010-11 varies from 176 to 5806 in the year 2017-18. It has reached to 7 categories of respondents (such as Executives, Home Makers, Middle Income Group, Retirement Planning, School Children, Self Help Group and Young Investors) of different states throughout the country. Under NRO highest number of programmes has been organised in Uttar Pradesh i.e. 1538 in 2017-18. Under ERO highest number of programmes has been organised in Odisha i.e. 326 in the year 2017-18. In West Bengal the numbers of awareness programmes are 150.In case of WRO, 325 awareness programmes were organised in the year 2017-18 only in the state Gujarat. Under SRO highest number (326) of programmes has been organised in Tamil Nadu and in case of HO i.e. SEBI Bhavan BKC organised 1282 IAPs through RPs in Maharashtra.

As a part of their social responsibility initiatives SEBI has organised Regional seminars, Visit to SEBI programme and Joint programmes with other institutions, apart from organising IAP or workshops through resource persons, with an aim to make people financially aware and protect their financial interest.

Visit to Sebi:

SEBI invites students from schools, colleges and professional institutes who are interested to learn about SEBI and its role as a regulator of securities markets through a visit to SEBI. The program was started in 2010 and has been quite popular. Such visits from educational institutions have happened and participants from different parts of the country. Details of yearwies Visit to SEBI programs is as under:

| Year | No. of Visit by Colleges& other Institutions | No. of Students |

| 2010-11 | 8 | 287 |

| 2011-12 | 30 | 1,538 |

| 2012-13 | 41 | 1,957 |

| 2014-15 | 167 | 5,421 |

| 2015-16 | 273 | 11,013 |

| 2016-17 | 567 | 21,808 |

| 2017-18 | 384 | 16,044 |

Source: Annual Reports of SEBI

Joint Programs:

The number of Joint Programmes organised by SEBI in the year 2017-18. In HO one programme has been conducted in the year 2017-18. In NRO, 50 joint programmes have been organised where total 3541 participants have participated. Under ERO total number of programmes has been conducted are 47 (Total number of participants are 2905). In case of WRO and SRO, 6 (455 participants) and 3 (60 participants) joint programmes have been arranged in the year 2017-18.

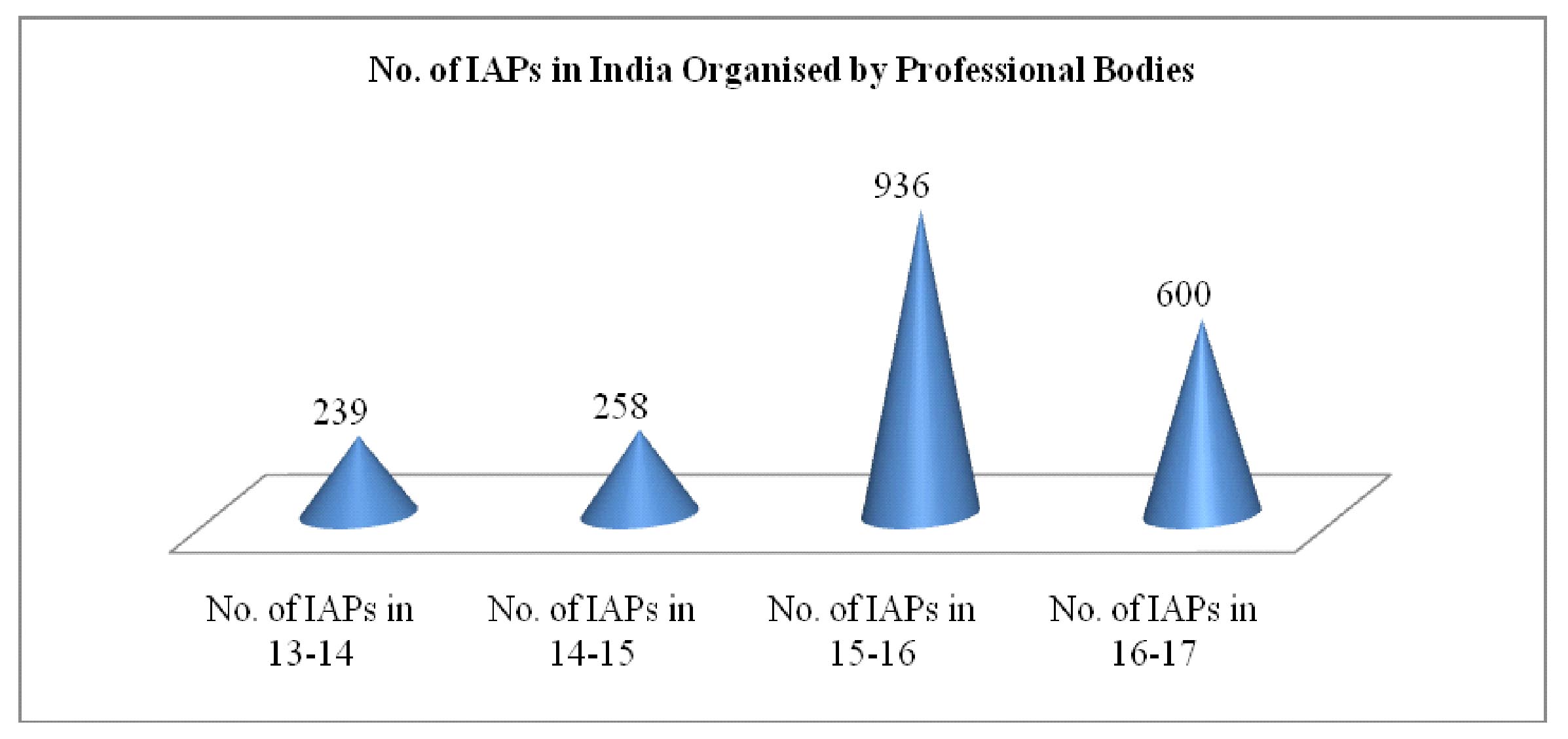

Institute of Companies Secretaries of India (ICSI):

Among the other professional bodies only Institute of Companies Secretaries mainly organise IAPs sponsored by MCA all over India. The details of the programmes organised by professional bodies sponsored by MCA during the past few years have been shown below:

| Year | No. of IAP Organized |

| 2013-14 | 239 |

| 2014-15 | 258 |

| 2015-16 | 936 |

| 2016-17 | 600 |

| Total | 2033 |

Source: Compiled by researcher

The graphical presentation of IAPs in organised by Professional Bodies is as follow:

Source: Prepared by the Researcher

Some Important findings:

- As per the results of the study also it is clear that financial knowledge and awareness have been increased as well as the perceptions regarding financial decision making or investment portfolios of the school students have been improved after attending such programme though it has no direct impact on the financial decision making of the students as they are not existing investors. There is a significant contribution by these bodies in enhancing financial literacy.

- Moreover, there is a significant association between the academic qualification and the students’ financial awareness has been found in the study so it can be said that academic qualification of the school students has an impact on their financial knowledge and awareness.

- In the present study a significant relationship between financial knowledge and awareness and financial decision making is found along with some other factors which are too may affect the financial decisions or perceptions of investment portfolios of the college students.

- No demographic variables such as Age, Gender, Marital Status, Family Income, Academic Qualification and Guardians’ Academic Qualification have any significant impact on the financial knowledge and awareness of the college students.

- It is also seen by comparing the responses of the pre and post programme that the financial awareness level of the college students has improved after attending the programme though it is not significant.

- But when the post programme responses of the college students have been compared with the responses of some other group of college students who did not attend such type of programme ever, the results found positive i.e. the financial awareness level is higher or better of the college students who have attended such programme than the other students who have not attended such programme.

- So, in case of college students, the IAPs and FEWs have impact to an extent on improving the perception of investment portfolio and financial decision making through contributing towards improving the financial awareness level of the students.

- Now the third category of respondents is the middle income group who are the existing investors and often directly involved in investment of their savings into different avenues according to their perspective or requirement. The result shows a significant relationship between financial knowledge and awareness and financial decision making along with some other factors like Influence of Personal Relationships and Individual Perception which may affect the financial decisions or perceptions of investment portfolios of the middle income group investors too.

- No demographic variables such as Age, Gender, Marital Status, Family Income, Academic Qualification and Number of Dependents in the Family have any significant impact on the financial knowledge and awareness of the middle income group.

- But when the post programme responses of the middle income group investors have been compared with the responses of some other group of investors who did not attend such type of programme ever, the results are found positive i.e. the financial awareness level is higher or better of the investors who have attended such programme than the other investors who have not attended such programme.

- So, in case of existing investors also, the IAPs have impact to an extent on improving the perception of investment portfolio and financial decision making through contributing towards improving the financial awareness level of the investors.

- The deliberation of resource persons plays an important role behind the success of IAPs.

Conclusion:

Investors’ Awareness Programmes (IAP) and Financial Education Workshops (FEWs) related to spreading financial knowledge and awareness among the participants so it has a contribution behind increasing financial literacy as well as financial awareness. The financial literacy and financial awareness are the factors that contribute towards sound financial planning and decision making of the potential or existing investors. It is also seen by comparing the responses of the pre and post programme that the financial awareness level of the middle income group investors has changed significantly after attending the programme but in a negative direction. But it does not imply that the awareness level of the middle income group investors has decreased after attending the programme as it is apparent that the awareness programmes can not reduce the knowledge of any participant rather it can provide the realisation to any participant regarding his or her own level of awareness. Therefore after attending the programme they may discover that they are far below the level of awareness as they thought off before attending such programme.

The Resource persons are very much dedicated towards their deliberation and spreading financial awareness which is very crucial for the effectiveness of the FEWs and IAPs. The sound knowledge of resource persons about financial planning and other financial matters good communicative skill and fluency in local languages is very important for increasing the efficiency of their deliberations and the efficacy of the FEWs and IAPs. The Proper training programme should be arranged by the authorities to ensure more enriched deliberations from the resource persons in FEWs and IAPs.

References:

- Ayers A. Cheryl (2012), “Empowering All Students with a Secure Economic and Financial Future: Multidisciplinary Investment Education in Social Studies Curricula and Beyond”, Journal of Consumer Education, 29, (1-13).

- Bhushan Puneet (2014), “Insight into Awareness level and Investment Behaviour of Salaried Individuals towards Financial Products”, International Journal of Engineering, Business and Enterprise Applications, ISSN (Print): 2279-0020 8(1), March-May, 2014, pp. 53-57.

- Bowen Faulcon Cathy (2002), “Financial Knowledge Of Teens And Their Parents”, Financial Counselling and Planning, Volume 13(2).

- Cochran C. A. (2010), “Financial Literacy in Teens”, Dissertation submitted in partial fulfilment of the requirements for the degree of Master of Arts in the Graduate Program, Caldwell College.

- Cullen Camille (2013), “Financial Literacy Among Graduate Students”, A Thesis submitted in partial fulfilment of the requirements for the degree of Master of Arts in Liberal Studies, Empire State College, State University of New York.

- Donohue Melissa (2011), “Financial Literacy and Women: A Mixed Method Study of Challenges and Needs”, Dissertation Submitted to the Graduate School of the University of Massachusetts in partial fulfilment of the requirements for the degree of Doctor of Education.

- Gaudecker von Hans-Martin (2013), “How does household portfolio diversification vary with financial literacy and financial advice?”, Discussion paper of NETSPAR(Network for Studies on Pensions, Aging and Retirement), DP 03/2011-026 (revised version December 7, 2013).

- Johnson E. and Sherraden S. Margaret (2006), “From Financial Literacy to Financial Capability Among Youth”, Working Paper, Centre for Social Development, Washington University.

- Lusardi A. and Mitchell S. Olivia (2005), “Financial Literacy and Planning: Implications for Retirement Wellbeing”, working paper of Michigan Retirement Research Centre, University of Michigan.

- Lusardi A. and Mitchell S. Olivia (2007), “Financial literacy and retirement preparedness:

- Evidence and implications for financial education programs”, CFS Working Paper, No. 2007/15, Centre for Financial Studies (CFS), Goethe University Frankfurt.

- Margarida Abreu and V. Mendes (2005), “Financial Literacy and Portfolio Diversification”.

- Peng Martina Tzu-Chin, Bartholomae Suzanne, Fox J. Jonathan and Cravener Garrett (2007), “ The Impact of Personal Finance Education Delivered in High School and College Courses”, J Fam Econ Iss (2007) 28:265–284 DOI 10.1007/s10834-007-9058-7.

- Surikhi Al Fanash Hmoud (2012), “Knowledge and Financial Management in Households: An Examination of Married Women’s Perspectives in Chadbourn, North Carolina”, A Capstone Paper submitted in partial fulfilment of the requirements for a Master’s degree in Sustainable Development at SIT Graduate Institute in Brattleboro, Vermont, USA.

Author

Dr. Ram Prahlad Choudhary

Associate Professor,

Department of Commerce, University of Calcutta

&

Mrs. Parna Banerjee

Research Scholar,

Department of Commerce, University of Calcutta

Published

Banking Finance : August 2018 issue