Digital Trust in Banking – a Critical Perspective

Abstract of the Article on “Digital Trust in Banking: Acritical Perspective”

In the digital era, trust has become a cornerstone for financial institutions as they navigate the complexities of online banking, mobile apps, and cryptocurrency exchanges. This article explores the concept of digital trust in banking, emphasizing its significance in safeguarding customer data, ensuring secure transactions, and adhering to regulations. It delves into the key components of digital trust, such as security, privacy, transparency, and ethical technology use, and outlines strategies for building and maintaining trust, including cybersecurity investment, clear communication, and customer education. The article also addresses the challenges of cybersecurity threats, regulatory complexities, and data breaches that impede trust development. By adopting a comprehensive approach to digital trust, banks can enhance customer loyalty, comply with regulations, and gain a competitive edge, thereby securing their place in an increasingly digital financial landscape. The conclusion highlights that in an environment where cyber threats are ever-present, maintaining digital trust is essential for banks to thrive in the future.

In today’s digital age, trust is paramount for financial institutions. The rise of online banking, mobile apps, and cryptocurrency exchanges has redefined customer-bank relationships. While offering convenience, these innovations also introduce new risks, demanding sophisticated security measures and unwavering commitment to customer data protection. This article examines digital trust in banking, exploring its definition, importance, key components, and strategies for building and maintaining it.

What is Digital Trust?

Digital trust is the confidence customers place in a financial institution’s ability to safeguard their data, ensure secure transactions, and comply with regulations. It encompasses technology, data management, operational transparency, and customer service, extending beyond physical bank branches. It’s about ethical conduct, clear communication, and regulatory adherence, not just secure platforms. The rapid shift to digital banking has raised customer expectations, demanding a more comprehensive approach to trust than traditional face-to-face interactions.

The Importance of Digital Trust in Banking

Digital trust is crucial for banking stability. Financial institutions handle highly sensitive customer data, including personal information, transaction history, and financial assets. As digital services expand, customers expect security, user-friendliness, and reliability. Trust is essential for customer confidence, loyalty, regulatory compliance, competitive advantage, and fostering innovation.

- Customer Confidence and Loyalty: Trust directly impacts customer retention. Surveys reveal that trust is a top factor in bank selection. Customers are more loyal to banks that demonstrably protect their data and respect their privacy. As banks introduce online lending, mobile banking, and digital wallets, maintaining digital trust becomes paramount.

- Regulatory Compliance and Risk Management: Banks must comply with data protection laws and cybersecurity protocols like GDPR and PCI DSS. Non-compliance leads to fines and reputational damage. Proactive risk management against cyberattacks, data breaches, and fraud is essential for building and sustaining trust.

- Competitive Advantage: In a competitive landscape with fintech companies and digital banks, digital trust is a differentiator. Banks prioritizing cybersecurity, transparent communication, and ethical standards attract and retain customers. Customers are more likely to adopt digital products like contactless payments and AI-driven advisory services if they trust data security.

Key Components of Digital Trust in Banking

Building digital trust requires focusing on security, transparency, privacy, data integrity, and ethical technology use.

- Security and Privacy: Protecting customer data from unauthorised access, cyberattacks, and fraud is fundamental. Robust security technologies like encryption, multi-factor authentication, and biometrics are crucial. Equally important is customer privacy, limiting data collection and sharing, ensuring customer control, and providing transparent privacy policies.

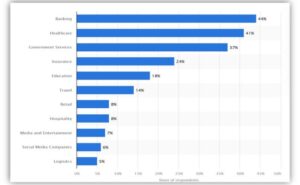

Share of consumers worldwide that trust digital services in 2024, by industry

- Transparency and Accountability: Customers need to understand how their data is used, who has access, and protection measures. Open communication about data sharing, security protocols, and policy changes builds confidence. Accountability is key; banks must respond swiftly to breaches or fraud, notifying customers and offering compensation.

- Digital Identity and Authentication: Secure and user-friendly authentication is essential. Biometric verification and blockchain solutions enhance security. Strong authentication prevents unauthorised access and protects transactions. Secure digital identities are crucial for trust and KYC compliance. Banks should strive for digital inclusion and ethical practices in identity management, ensuring data security and minimizing misuse.

- Data Integrity and Accuracy: Customers rely on accurate and up-to-date data. Regular audits, strong verification processes, and transparent reporting are necessary. AI and machine learning can detect inconsistencies and automate data processing, improving reliability.

- Ethical Use of AI and Automation: As AI becomes integral, ethical use is crucial. AI systems must be fair, transparent, and unbiased. Explainable AI allows customers to understand decisions. Mechanisms for contesting AI-driven decisions are essential.

Building Digital Trust: A Framework for Shared Goals

Digital trust requires meeting shared goals across geographies and use cases. A values-driven approach fosters trustworthy technologies. Three key goals are essential:

- Ensuring Reliability and Security of Services: Customers expect digital services to meet expectations and protect data. Reliability is tied to trust. Banks must be transparent about security standards and communicate how they are met.

- Accountability and Oversight: Governance practices are crucial. Banks must demonstrate accountability in maintaining financial and societal stability. Oversight of technology and data usage is essential. Clear responsibilities and mechanisms for addressing failures are necessary.

- Inclusive, Ethical, and Responsible Use: Banks must design and operate technology as stewards of society, ensuring broad access and ethical outcomes. Products must be developed respecting human rights. Standardised guidelines for technology design ensure consistent ethical practices. Frameworks for handling ethical dilemmas are crucial. Prioritizing ethical technology use builds stronger customer relationships.

Dimensions of Digital Trust in Banking

Eight critical dimensions must be considered: cybersecurity, safety, transparency, interoperability, auditability, redressability, fairness, and privacy. Both mechanical and relational trust strategies are essential.

- Mechanical Trust: Refers to systems delivering reliable results (e.g., blockchain).

- Relational Trust: Focuses on shared norms, expectations, and transparency in technology application and decision-making.

Cybersecurity

Cybersecurity secures digital banking systems, mitigating risks of unauthorised access and cyberattacks. It ensures data confidentiality, integrity, and availability. Robust cybersecurity protects vulnerable customers. It establishes accountability and enables oversight. Customers expect secure digital services and demand visible commitment to cybersecurity. Banks must communicate this commitment.

Transparency

Transparency builds trust and clarity around digital operations. It reduces information asymmetry. It showcases ethical decision-making. Banks should design for transparency, tracking data usage and generating reports. Transparency is a key activity in ensuring actions align with customer values and regulatory expectations.

Privacy in Banking

Privacy protects individual rights over financial information. It safeguards against unchecked data processing. Achieving privacy requires accountability and oversight, ensuring data is used for authorised purposes. Security measures protect privacy by preventing unauthorized access. Privacy programs must be integrated across functions, addressing strategy, policy management, cross-border data strategy, data lifecycle management, consent management, privacy by design, information security, incident management, data processor accountability, and training outcomes for all stakeholders. It’s linked to ethical technology use. Determining fairness requires balancing various factors. Banks must identify and mitigate potential biases in algorithms and decision-making processes, ensuring equal opportunity and access to financial services. Regular audits and impact assessments can help identify and address fairness concerns. Transparency about how decisions are made and mechanisms for redress are crucial.

Auditability: Relation to Digital Trust Goals

Inclusive, Ethical, and Responsible Use

In the banking sector, comprehensive audits are critical to assess progress toward ethical goals and commitments. Regular audits allow banks to measure their effectiveness in achieving inclusive, ethical, and responsible use of technology. By making audit results publicly available, banks can demonstrate to customers and stakeholders that they are upholding their commitments to fairness, equity, and transparency.

Implementation

Defining the Audit Scope Banks are typically well-versed in auditing quantitative procedures, such as financial transactions and data processing. However, when aiming to build digital trust, it’s essential to also apply auditability standards to qualitative procedures and decisions, such as customer service practices or algorithmic decision-making. The documentation and auditing of qualitative processes are vital to ensure that banks meet their commitments consistently. By addressing potential challenges in documenting these processes, banks can enhance transparency and accountability in their decision-making.

Safety in Banking Strengthening Digital Trust

Relation to Digital Trust Goals

In the banking sector, safety is essential to maintaining digital trust. It reflects an organisation’s commitment to upholding social norms, protecting users, and ensuring their well-being when interacting with financial technologies. Banks must take an inclusive, ethical, and responsible approach to safety by thoroughly examining the impact of safety measures in their operations. For instance,

- Is the safeguard in the best interest of the customer and their financial rights?

- Can all customers access and benefit from the safety measures?

- Does the safety mechanism demonstrate the bank’s role as a steward of customer trust?

By addressing these questions affirmatively, banks show their commitment to protecting users from harm and safeguarding their rights. This approach promotes digital trust, reassuring customers that their financial safety is prioritised, and their interests are being upheld.

Implementation

–Nuanced Approach to Harm Mitigation and Safety In the banking industry, safety is not a one-size-fits-all concept. Different banking products, services, and technologies pose different types of risks. For example, fraud detection systems, mobile apps, and digital wallets each present unique safety challenges. Banks must take a contextual approach to safety, considering factors such as the type of technology, the characteristics of the user, and the context in which the technology is used.

Challenges in Building Digital Trust in Banking

While digital trust is critical, several challenges can impede its development and maintenance. These include cybersecurity threats, regulatory complexities, customer education, and the risk of data breaches.

1. Cybersecurity Threats

The constant evolution of cyber threats remains one of the biggest obstacles to digital trust in banking. Cybercriminals are becoming increasingly sophisticated, developing new methods to breach security systems, steal customer data, and manipulate financial transactions. As a result, banks must continuously update their cybersecurity measures to stay ahead of emerging threats. This requires ongoing investment in both technology and skilled personnel.

2. Regulatory Complexity

Banks must navigate a complex and ever-evolving regulatory landscape. Different regions and countries have varying data protection, privacy, and cybersecurity requirements. This complexity is compounded for global banks that must ensure compliance with regulations in multiple jurisdictions. Staying up to date with regulatory changes and adapting to new legal requirements is a significant challenge in maintaining digital trust.

3. Customer Education

Many customers may not fully understand the risks and security implications associated with online banking. Phishing attacks, social engineering tactics, and identity theft are growing concerns that can only be mitigated through proper customer education. Banks must invest in customer awareness campaigns, tutorials, and educational resources to empower their customers to protect their accounts and personal information.

4. Data Breaches and Trust Erosion

Even the most secure banks are vulnerable to data breaches. When sensitive customer data is compromised, it can significantly damage the bank’s reputation and erode customer trust. In such cases, a bank’s response is crucial. Quickly notifying affected customers, providing credit monitoring services, and offering compensation are key steps in rebuilding trust after a breach.

Strategies for Enhancing Digital Trust in Banking

To build and sustain digital trust, banks must adopt a multifaceted strategy that encompasses the following approaches

1. Invest in Cybersecurity

Prioritizing cybersecurity investments, such as advanced encryption, AI-driven fraud detection, and continuous monitoring, is fundamental to protecting customer data. Proactive risk management and the use of cutting-edge security technologies can help prevent cyberattacks and mitigate potential threats.

2. Ensure Transparency and Clear Communication

Transparency is key to building and maintaining trust. Banks should regularly update customers on security enhancements, policy changes, and potential risks. In the event of a breach, prompt and clear communication is essential for mitigating damage to trust.

3. Leverage AI for Enhanced Security

AI and machine learning can be powerful tools in enhancing security. Banks should use these technologies to detect anomalies, prevent fraud, and streamline authentication processes. By leveraging AI, banks can stay ahead of emerging threats and improve the security of their digital platforms.

4. Adhere to Regulatory Standards

Banks must ensure compliance with relevant regulations, such as DPDP Act, GDPR, PCI DSS, and KYC requirements. Adherence to these standards not only ensures legal compliance but also reassures customers that their data is being handled responsibly.

5. Educate and Empower Customers

Investing in customer education is critical for maintaining digital trust. Banks should offer resources and training on how to protect personal data, recognise fraud attempts, and make safe use of digital banking services.

Conclusion

Digital trust is the foundation upon which modern banking is built. As financial institutions continue to adapt to the digital revolution, they must prioritise the security, transparency, and ethical handling of customer data. By investing in cybersecurity, leveraging AI, complying with regulatory standards, and educating customers, banks can foster long-term trust and loyalty. In doing so, they not only protect their reputation but also secure their future in an increasingly digital financial ecosystem. In a world where cyber threats are omnipresent and customer expectations are constantly evolving, maintaining digital trust has become a necessity, not a luxury. It is the key to surviving and thriving in the future of banking.

Author:

C V S Umakanth,

M Com, ICWAI, CISA

Chief Manager (Systems) , Faculty

State Bank Institute of Innovation and Technology

Hyderabad