Bitcoin – Future Currency of the World

Introduction

Bitcoin is the first successful internet money based on peer-to-peer technology; whereby no central bank or authority is involved in the transaction and production of the Bitcoin currency. It was created by an anonymous individual/group under the name, Satoshi Nakamoto. The source code is available publicly as an open source project, anybody can look at it and be part of the developmental process. Bitcoins are electronic currency, otherwise known as ‘cryptocurrency’. Bitcoins are a form of digital public money that is created by painstaking mathematical computations and policed by millions of computer users called ‘miners’. Bitcoins are, in essence, electricity converted into long strings of code that have money value.

Bitcoin is changing the way we see money as we speak. It is a decentralized peer-to-peer internet currency making mobile payment easy, very low transaction fees, protects identity, and it works anywhere all the time with no banking hours. Being the first successful online cryptography currency, Bitcoin has inspired other alternative currencies such as Litecoin, Peercoin, Primecoin, and so on.

Concept of Bitcoin

Bitcoin is a digital currency (also called crypto-currency) that is not backed by any country’s central bank or government. Bitcoins can be traded for goods or services with vendors who accept Bitcoins as payment. Bitcoins are generally defined as a type of virtual currency, brought to life by the Internet, very powerful computers and the willingness of lot of people looking to embrace new forms of monetary exchange.

Bitcoin is a digital currency created in 2009. It follows the ideas set out in a white paper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms and is operated by a decentralized authority, unlike government-issued currencies. Today’s market cap for all bitcoin (abbreviated BTC or, less frequently, XBT) in circulation exceeds $7 billion.

There are no physical bitcoins, only balances kept on a public ledger in the cloud, that – along with all Bitcoin transactions – is verified by a massive amount of computing power. Bitcoins are not issued or backed by any banks or governments, nor are individual bitcoins valuable as a commodity. Despite its not being legal tender, Bitcoin charts high on popularity, and has triggered the launch of other virtual currencies collectively referred to as Altcoins.

Growth and Development of Bitcoin

Bitcoin is a cryptocurrency, a digital asset designed to work as a medium of exchange that uses cryptography to control its creation and management, rather than relying on central authorities. The presumed pseudonymous Satoshi Nakamoto integrated many existing ideas from the cypherpunk community when creating bitcoin.

On 18 August 2008, the domain name bitcoin.org was registered. In November that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System was posted to a cryptography mailing list. This paper detailed methods of using a peer-to-peer network to generate what was described as “a system for electronic transactions without relying on trust”. In January 2009, the bitcoin network came into existence with the release of the first open source bitcoin client and the issuance of the first bitcoins,with Satoshi Nakamoto mining the first block of bitcoins ever (known as the genesis block), which had a reward of 50 bitcoins.

History of Bitcoin Value (US$)

| Date | Developments |

| Jan 2009 – Mar 2010 | No exchanges or market, users were mainly cryptography fans who were sending bitcoins for hobby purposes representing low or no value. In March 2010, user “SmokeToo Much” auctioned 10,000 BTC for $50 (cumulatively), but no buyer was found. |

| Mar 2010 | On 17 Mar 2010, the now-defunct Bitcoin Market.com exchange is the first one that starts operating. |

| May 2010 | On 22 May 2010, Laszlo Hanyecz made the first real-world transaction by buying two pizzas in Jacksonville, Florida for 10,000 BTC. |

| July 2010 | In five days, the price grew 1000%, rising from $0.008 to $0.08 for 1 bitcoin. |

| Feb – April 2011 | Bitcoin takes parity with US dollar. |

| Nov 2013 | From October $150–$200 in November, rising to $1,242 on 29 November 2013. |

| Dec 2013 | Price crashed to $600, rebounded to $1,000, crashed again to the $500 range. Stabilized to the ~ $650–$800 range. |

| Jan 2014 | Price spiked to $1000 briefly, then settled in the $800–$900 range for the rest of the month. |

| Mar 2014 | Price continued to fall due to a false report regarding bitcoin ban in China and uncertainty over whether the Chinese government would seek to prohibit banks from working with digital currency exchanges. |

| Early Nov 2015 | Large spike in value from 225–250 at the start of October to the 2015 record high of $504. |

| May–June 2016 | Large spike in value starting from $450 and reaching a maximum of $750. |

| Oct-Nov 2016 | As the Chinese Renminbi depreciated against the US Dollar, bitcoin rose to the upper $700s. |

| 2-3 March 2017 | Price broke above the November 2013 high of $1,242 and then traded above $1,290. |

| May 2017 | Price reached a new high, reaching US$1,402.03 on 1 May 2017, and over US$1,800 on 11 May 2017. On 20 May 2017, the price of one bitcoin passed US$2,000 for the first time. |

| May–June 2017 | Price reached an all-time high of $3,000 on 12 June and is oscilating around $2,500 since then. As of 6 August 2017, the price is $3,270. |

| August 2017 | On 5 August 2017, the price of one BTC passed US$3,000 for the first time. On 12 August 2017, the price of one BTC passed US$4,000 for the first time. Two days later, the price of one BTC passed US$4,400 for the first time. |

| September 2017 | On 1 September 2017, bitcoin broke US$5,000 for the first time, topping out at US$5,013.91. |

| 25 Nov 2017 | Bitcoin surpasses the $9,000 mark for the first time. |

| 28 Nov 2017 | Bitcoin surpasses $10,000 for the first time. |

| 29 Nov 2017 | Bitcoin surpasses $11,000 for the first time. |

Growth of Bitcoins – Number and Price

| Year | Number of Bitcoins | End of the Year | Price ($) |

| 2009 January 3 | 50 | 2009 | $ 0.07 |

| 2010 January 1 | 16,23,400 | 2010 | $ 0.29 |

| 2011 January 1 | 50,27,250 | 2011 | $ 6.18 |

| 2012 January 3 | 80,23,200 | 2012 | $ 13.14 |

| 2013 January 3 | 1,06,25,175 | 2013 | $ 817.00 |

| 2014 January 4 | 1,22,15,225 | 2014 | $ 314.00 |

| 2015 January 1 | 1,36,74,725 | 2015 | $ 431.00 |

| 2016 January 2 | 1,50,35,400 | 2016 | $958.24 |

| 2107 January 3 | 1,60,81,387.50 | 2017 November 30 | 9907.00 |

Price Growth of Bitcoin in 2017

| End of Month | Price(Rs) = 1 Bitcoin BTC/INR |

| January | 64,898 |

| February | 78,800 |

| March | 69,527 |

| April | 86,205 |

| May | 1,50,135 |

| June | 1,61,888 |

| July | 1,84,044 |

| August | 3,03,876 |

| September | 2,83,743 |

| October | 4,16,594 |

| November | 6,75,543 |

| Average | 225023 |

Source : www.mataf.net

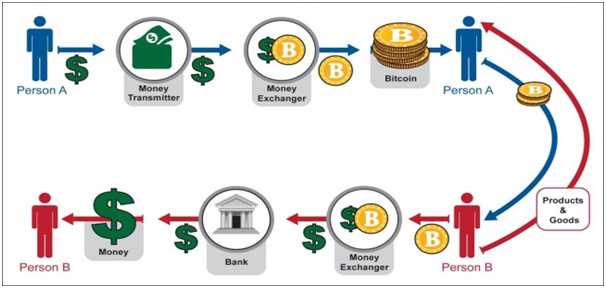

Process and Works of Bitcoin

Bitcoin is one of the first digital currencies to use peer-to-peer technology to facilitate instant payments. The independent individuals and companies who own the governing computing power and participate in the Bitcoin network, also known as “miners,” are motivated by rewards (the release of new bitcoin) and transaction fees paid in bitcoin. These miners can be thought of as the decentralized authority enforcing the credibility of the Bitcoin network. New bitcoin is being released to the miners at a fixed, but periodically declining rate, such that the total supply of bitcoins approaches 21 million. One bitcoin is divisible to eight decimal places (100 millionth of one bitcoin), and this smallest unit is referred to as a Satoshi. If necessary, and if the participating miners accept the change, Bitcoin could eventually be made divisible to even more decimal places.

Bitcoin mining is the process through which bitcoins are released to come into circulation. Basically, it involves solving a computationally difficult puzzle to discover a new block, which is added to the blockchain, and receiving a reward in the form of few bitcoins. The block reward was 50 new bitcoins in 2009; it decreases every four years. As more and more bitcoins are created, the difficulty of the mining process – that is, the amount of computing power involved – increases. The mining difficulty began at 1.0 with Bitcoin’s debut back in 2009; at the end of the year, it was only 1.18. As of April 2017, the mining difficulty is over 4.24 billion. Once, an ordinary desktop computer sufficed for the mining process; now, to combat the difficulty level, miners must use faster hardware like Application-Specific Integrated Circuits (ASIC), more advanced processing units like Graphic Processing Units (GPUs), etc.

If A sends some bitcoins to B, that transaction will have three pieces of information:

- An input: This is a record of which bitcoin address was used to send the bitcoins to B in the first place.

- An amount. This is the amount of bitcoins that B is sending to A.

- An output: This is A,s bitcoin address.

Balances – block chain: The block chain is a shared public ledger on which the entire Bitcoin network relies. All confirmed transactions are included in the block chain. This way, Bitcoin wallets can calculate their spendable balance and new transactions can be verified to be spending bitcoins that are actually owned by the spender. The integrity and the chronological order of the block chain are enforced with cryptography.

Transactions – Private keys : A transaction is a transfer of value between Bitcoin wallets that gets included in the block chain. Bitcoin wallets keep a secret piece of data called a private key or seed, which is used to sign transactions, providing a mathematical proof that they have come from the owner of the wallet. The signature also prevents the transaction from being altered by anybody once it has been issued. All transactions are broadcast between users and usually begin to be confirmed by the network in the following 10 minutes, through a process called mining.

Processing – Mining : Mining is a distributed consensus system that is used to confirm waiting transactions by including them in the block chain. It enforces a chronological order in the block chain, protects the neutrality of the network, and allows different computers to agree on the state of the system. To be confirmed, transactions must be packed in a block that fits very strict cryptographic rules that will be verified by the network. These rules prevent previous blocks from being modified because doing so would invalidate all following blocks. Mining also creates the equivalent of a competitive lottery that prevents any individual from easily adding new blocks consecutively in the block chain. This way, no individuals can control what is included in the block chain or replace parts of the block chain to roll back their own spends.

Advantages of Bitcoins

Very Low Fees

Currently there are either no fees, or very low fees within Bitcoin payments. With transactions, users might include fees in order to process the transactions faster. Digital Currency exchanges help merchant process transactions by converting bitcoins into fiat currency.

Irreversible Transactions

As existing merchants will be well aware, when accepting credit card payments, or even bank payments the sender has the ability to reverse or “chargeback” the payment. There is nothing worse than sending products to a customer, only to receive a message that the payment has been reversed. Bitcoin is the only payment method that is 100% irreversible and cannot be charged back.

No Paperwork

Anyone, from any country, of any age can accept Bitcoins within minutes. There is no ID card, passport or proof of address that all conventional banks required to open an account. All people need to do to start sending and receiving Bitcoins is to download a Bitcoin Wallet program and generate a Bitcoin Address. Therefore no paperwork for bitcoin transaction.

Appreciating Value

The value of Bitcoins were initially highly volatile during the first few years of it’s inception, however during the last 6 months the currency has stabilized and has been steadily increasing in value on a daily basis.

Quick and Cheap Transactions

When making a Bitcoin transfer the fees are extremely low compared to conventional methods of moving money. A normal Bitcoin fee is 0.0005 Bitcoin (BTC) per transfer, whereas with a typically international wire transfer could expect to pay 700THB-1300THB per transaction. Accepting credit cards will generally cost 3-5% of the transfer amount, which again is much more expensive than a Bitcoin transaction. International wire transfers can take from a few days to more than a week, whereas Bitcoin transactions are generally confirmed with an hour.

No Third-Party Seizure

Since there are multiple redundant copies of the transactions database, no one can seize bitcoins. The most someone can do is force the user, by other means, to send the bitcoins to someone else. This means that governments can’t freeze someone’s wealth, and thus users of Bitcoins will have complete freedom to do anything they want with their money.

No Taxes

There is no way for a third party to intercept transactions of Bitcoins, and therefore there is no viable way to implement a Bitcoin taxation system. The only way to pay a tax would be, if someone voluntarily sends a percentage of the amount being sent as tax.

No Tracking

Unless users publicize their wallet addresses publicly, no one can trace transactions back to them. No one, other than the wallet owners, will know how many Bitcoins they have. Even if the wallet address was publicized, a new wallet address can be easily generated. This greatly increases privacy when compared to traditional currency systems, where third parties potentially have access to personal financial data.

No Transaction Costs

Sending and receiving Bitcoins requires users to keep the Bitcoin client running and connected to other nodes. Essentially, by using bitcoins users will be contributing to the network, and thus sharing the burden of authorizing transactions. Sharing this work greatly reduces transaction costs, and thus makes transaction costs negligible.

No Risk of “Charge-backs”

Once Bitcoins are sent, the transaction cannot be reversed. Since the ownership address of Bitcoins will be changed to the new owner, once it is changed, it is impossible to revert. Since only the new owner has the associated private key, only he/she can change ownership of the coins. This ensures that there is no risk involved when receiving Bitcoins.

Bitcoins Cannot be Stolen

Bitcoins’ ownership address can only be changed by the owner. No one can steal Bitcoins unless they have physical access to a user’s computer, and they send the bitcoins to their account. Unlike convential currency systems, where only a few authentication details are required to gain access to finances, this system requires physical access, which makes it much harder to steal.

Limitations of Bitcoin

Bitcoins Are Not Widely Accepted

Bitcoins are still only accepted by a very small group of online merchants. This makes it unfeasible to completely rely on Bitcoins as a currency. There is also a possibility that governments might force merchants to not use Bitcoins to ensure that users’ transactions can be tracked.

Wallets Can Be Lost

If a hard drive crashes, or a virus corrupts data, and the wallet file is corrupted, Bitcoins have essentially been “lost”. There is nothing that can done to recover it. These coins will be forever orphaned in the system. This can bankrupt a wealthy Bitcoin investor within seconds with no way form of recovery. The coins the investor owned will also be permanently orphaned.

Bitcoin Valuation Fluctuates

The value of Bitcoins is constantly fluctuating according to demand. As of June 2nd 2011, one Bitcoins was valued at $9.9 on a popular bitcoin exchange site. It was valued to be less than $1 just 6 months ago. This constant fluctuation will cause Bitcoin accepting sites to continually change prices. It will also cause a lot of confusion if a refund for a product is being made.

No Buyer Protection

When goods are bought using Bitcoins, and the seller doesn’t send the promised goods, nothing can be done to reverse the transaction. This problem can be solved using a third party escrow service like Clear Coin, but then, escrow services would assume the role of banks, which would cause Bitcoins to be similar to a more traditional currency.

Risk of Unknown Technical Flaws

The Bitcoin system could contain unexploited flaws. As this is a fairly new system, if Bitcoins were adopted widely, and a flaw was found, it could give tremendous wealth to the exploiter at the expense of destroying the Bitcoin economy.

Built in Deflation

Since the total number of bitcoins is capped at 21 million, it will cause deflation. Each bitcoin will be worth more and more as the total number of Bitcoins maxes out. This system is designed to reward early adopters. Since each bitcoin will be valued higher with each passing day, the question of when to spend becomes important. This might cause spending surges which will cause the Bitcoin economy to fluctuate very rapidly, and unpredictably.

No Physical Form

Since Bitcoins do not have a physical form, it cannot be used in physical stores. It would always have to be converted to other currencies. Cards with Bitcoin wallet information stored in them have been proposed, but there is no consensus on a particular system. Since there would be multiple competing systems, merchants would find it unfeasible to support all Bitcoin cards, and therefore users would be forced to convert Bitcoins anyway, unless a universal system is proposed and implemented.

No Valuation Guarantee

Since there is no central authority governing Bitcoins, no one can guarantee its minimum valuation. If a large group of merchants decide to “dump” Bitcoins and leave the system, its valuation will decrease greatly which will immensely hurt users who have a large amount of wealth invested in Bitcoins. The decentralized nature of bitcoin is both a curse and blessing.

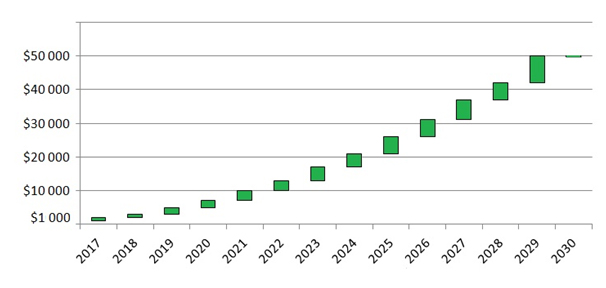

Future Growth of Bitcoin

Among the main reasons for such price jumps in 2017, some experts mention the political situation in the US (new strategy of president Donald Trump), Europe (facing Brexit and elections in Netherlands, and France), Bitcoin adoption in Japan, the warming attitude towards Bitcoin in Russia, etc.

Furthermore, Peter Smith, Blockchain CEO and co-founder, and Jeremy Liew, the first investor in Snapchat, suggested that bitcoin’s price could reach $500,000 by 2030. If we imagine that this will happen and the price rises gradually, the Bitcoin charts for 2017-2030 may look like this:

Conclusion

Bitcoin is one of the world’s most popular digital currencies, meaning that it is exclusively created and held electronically. Our children today by the time they reach adulthood, will transact in a world where everyone uses Bitcoin. The security problems and the lack of clarity about digital currencies regulation will continue to be prevalent in the next future.

References

- Alexander, D’Alfonso, Peter Langer and Zintis Vandelis “The Future of Cryptocurrency – An Investor’s Comparison of Bitcoin and Ethereum” Ryerson University, October 17 2016.

- Anton Badev and Mathew Chen “Bitcoin: Techinical Background and Data Analysis” Division of Research & Statistics and Monetory Affairs Federal Reserve Board, Washington, October 7, 2014.

- https://charts.bitcoin.com/chart/price

- https://www.coingecko.com/en/coins/bitcoin#panel

- https://www.investopedia.com/terms/b/bitcoin.asp

- https://www.lifewire.com/what-are-bitcoins-2483146

- https://bitcoin.org/en/how-it-works

- https://www.howtogeek.com/235705/how-does-shopping-with-bitcoin-work/

- https://bitcoin.co.th/benefits-of-bitcoin/

- http://cs.stanford.edu/people/eroberts/cs181/projects/2010-11/DigitalCurrencies/advantages/index.html

- http://cs.stanford.edu/people/eroberts/cs201/projects/2010-11/DigitalCurrencies/disadvantages/index.html

- https://en.wikipedia.org/wiki/History_of_bitcoin

- https://www.coindesk.com/second-wave-bitcoin-price-growth-may-just-beginning/

- https://knoema.com/rilqhnd/bitcoin-currency-statistics-2009-2017

Author

| V.LAVANYA M.Phil, Research Scholar Department of Commerce Sri S.R.N.M College, Sattur Virudhunagar, Tamil Nadu |

DR S.JEYAKUMAR Assistant Professor PG & Research Department of Commerce P.M.T College, Melaneelithanallur Sankarankovil – Tirunelveli, Tamil Nadu |