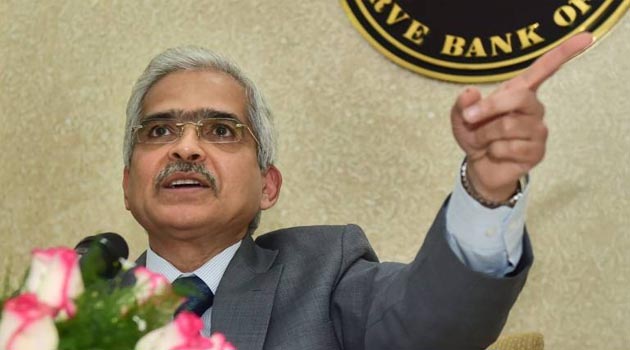

RBI raises repo rate by 40 bps

Monetary Policy Committee (MPC) of the RBI unanimously decided to increase the repo rate by 40 basis points (bps) in an off-cycle meeting, citing inflation concern.

This was followed by a 50 bps hike in the cash reserve ratio to 4.5 per cent, which will drain out Rs 87,000 crore liquidity from the banking system.

This was the first repo rate hike in 45 months — since August 2018. The increase in the repo rate will lead to lending rates getting pushed up because 40 per cent of the loans of commercial banks are linked to it.

The 10-year government bond shot up 26 bps, with the street expecting another rate hike in the June policy. As a result, the standing deposit facility (SDF) rate is now at 4.15 per cent and the marginal standing facility (MSF) rate at 4.65 per cent.