CBDT to I-T: Do not reopen sub-Rs. 50L cases for AYs ’14-16

The Central Board of Direct Taxes (CBDT) has issued exhaustive instructions to its income tax (I-T) cadre on reopening of cases to implement the recent Supreme Court order. These instructions will keep small cases relating to some past years from being reopened.

As had been reported by TOI, according to this order, nearly 90,000 re-assessment notices that were issued by the I-T department after April 1, 2021 under the provisions of the unamended section 148 were held valid.

However, the order provided that safeguards under the new provisions introduced by the Finance Act, 2021 should be followed.

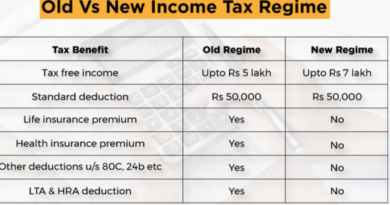

To begin with, CBDT’s instructions state that notices cannot be issued in cases for assessment years (AYs) 2013-14, 2014-15 and 2015-16 if the income escaping assessment is likely to be less than Rs 50 lakh.

In cases of income that have escaped assessment, under section 148 (old regime) the I-T officer could reopen cases dating back to six years. Under section 148A (introduced by the Finance Act, 2021), cases dating back to 10 years can be reopened only if the income that has escaped assessment is over Rs 50 lakh and if a proper process is followed.

For AYs 2016-17 and 2017-18, the CBDT has clarified in its instructions that fresh notices can be issued with approval of the higher officers, as the time limit of three years has not lapsed.

Dhruva Advisors partner Ajay Rotti told, “CBDT’s issuance of these instructions is a welcome move.”