Payment & Small Finance Banks – A step to foster Financial Inclusion

Introduction :

Providing banking services to deprived people, at affordable rates, is amongst top national priorities. Deep concerns in regard to the banking practices that tend to exclude rather than attract vast sections of population from the formal financial system , urged the RBI to continue its efforts to ensure extension of banking facilities to all unbanked villages and evolve policy guidelines to address this issue .In 2014, ,the government , in a major initiative to extend formal financial services to the excluded population, launched Pradhan Mantri Jan Dhan Yojna ( PMJDY). With 1.2 billion citizens and 650,000 villages spreading over 3.288 million sq km area, the growth recorded so far, though gratifying, is nowhere near our fellow emerging markets. Considering the size of India‘s population and the need for massive efforts to narrow the social and economic divide, it was felt that more agencies should be brought in to strengthen the efforts for financial inclusion..In an attempt to make sure that all sections of society and people living in remote rural areas have access to banking facilities, the RBI with the objective of furthering financial inclusion , worked on the proposal to introduce niche & differentiated banks i.e small finance banks ( SFBs) and payment banks. It is the strong opinion of the regulatory authority that the Small and Payments banks are the way forward for India to achieve financial inclusion. Thus based on the feedback received on draft guidelines, RBI came out with final guidelines for Payment Banks and Small Finance Banks in November 2014. RBI granted “in-principle” approval to 11 Applicants for Payments Banks on August 19,2015 and to 10 applicants for Small Finance Banks (SFBs ).This paper discusses the RBI’s licensing guidelines for small finance banks and payments banks, opportunities ,challenges and these niche bank’s role in the banking space.

RBI’s licensing guidelines for Payment Banks

Objectives :

The objectives of setting up of payments banks will be to further financial inclusion by providing (i) small savings & current deposit accounts and (ii) payments/remittance services to migrant labour workforce, low income households, small businesses, other unorganised sector entities and other users.

Eligible promoters :

1)Existing non-bank Pre-paid Payment Instrument (PPI) issuers; and other entities such as individuals / professionals; Non-Banking Finance Companies (NBFCs), corporate Business Correspondents(BCs), mobile telephone companies, super-market chains, companies, real sector cooperatives; that are owned and controlled by residents; and public sector entities may apply to set up payments banks.

2)A promoter/promoter group can have a joint venture with an existing scheduled commercial bank to set up a payments bank. However, scheduled commercial bank can take equity stake in a payments bank to the extent permitted under Section 19 (2) of the Banking Regulation Act, 1949.

3)Promoter/promoter groups should be ‘fit and proper’ with a sound track record of professional experience or running their businesses for at least a period of five years in order to be eligible to promote payments banks.

Scope of activities :

1)Acceptance of demand deposits. Payments bank will initially be restricted to holding a maximum balance of Rs. 100,000 per individual customer.

2)Issuance of ATM/debit cards. Payments banks, however, cannot issue credit cards.

3)Payments and remittance services through various channels.

4)BC of another bank, subject to the Reserve Bank guidelines on BCs.

5)Distribution of non-risk sharing simple financial products like mutual fund units and insurance products, etc.

Deployment of funds :

1)The payments bank cannot undertake lending activities.

2)Apart from amounts maintained as Cash Reserve Ratio (CRR) with the Reserve Bank on its outside demand and time liabilities, it will be required to invest minimum 75 per cent of its “demand deposit balances” in Statutory Liquidity Ratio (SLR) eligible Government securities/treasury bills with maturity up to one year and hold maximum 25 per cent in current and time/fixed deposits with other scheduled commercial banks for operational purposes and liquidity management.

Capital requirement :

The minimum paid-up equity capital for payments banks shall be Rs. 100 crore. The payments bank should have a leverage ratio of not less than 3 per cent, i.e., its outside liabilities should not exceed 33.33 times its net worth (paid-up capital and reserves).

Promoter’s contribution:

The promoter’s minimum initial contribution to the paid-up equity capital of such payments bank shall at least be 40 per cent for the first five years from the commencement of its business.

Foreign shareholding:

The foreign shareholding in the payments bank would be as per the Foreign Direct Investment (FDI) policy for private sector banks as amended from time to time.

Other conditions :

1)The operations of the bank should be fully networked and technology driven from the beginning, conforming to generally accepted standards and norms.

2)The bank should have a high powered Customer Grievances Cell to handle customer complaints.

Payment Banks’ Role –Opportunities and Challenges

Payment banks will complement banking services offered by commercial banks and are expected to play its role in promoting financial inclusion. The main activities of these banks are i) opening of bank saving bank and current deposit accounts for those that have never had one and ii) allowing people to send and receive money easily, but however cannot carry out lending activities. Thus, they can issue ATM/debit cards, but cannot issue credit cards. These banks aim at bringing the unbanked masses such as migrant labourers, low income households, small businesses, and other unorganised sector entities under the ambit of formal banking and expedites financial inclusion by making it easier for them to get a bank account. Payment banks may make handling cash a lot easier through mobile phone and point-of-sale (POS) terminals. Payments banks have the potential to be more agile and nimble, and hence are more responsive to changing market trend. Innovation with technology, they can provide optimum and highly efficient banking services. With few or no legacy constraints and greater responsiveness to customer needs they may attract a large pool of well-served, underserved as well as unserved customers in the banking space.

Opportunities & Role

- RBI has granted “in-principle” approval to 11 applicants to set up payments banks under the Guidelines for Licensing of Payments Banks issued on November 27, 2014 (Guidelines). RBI has issued licenses to Companies which are into supermarket chains (have a large distribution network), mobile operators (have a large customer base), or the postal services which taps in a large number of customers. The savings and remittance services of payment banks, target people living in rural areas, or have limited/no access to banks. Since these Companies have a vast distribution network or a customer base, they help in financial penetration and ensure banking services to reach every nook and corner in the country. This promotes financial savings among the poorest of the poor in the nation. Airtel’s 228 million customers, Vodafone’s 184 million and Idea’s 160 million adds 572 million potential payments bank customers from just three future payments banks. India Post, with 1.39 lacs post offices, which is nearly three times of bank branches in rural areas, can serve several hundred million customers from its branches. Pay TM already has 25 million e-wallet customers, who are all potential targets for its payments bank. Payments banks will essentially rely on technology using mobile as the vehicle of banking. Physical bank branches or ATMs will still be needed for some functions like opening an account, depositing cash, etc. but day-to-day payments and peer-to-peer payments can be done remotely. More people in India have a mobile phone subscription than a bank account. Mobile phones are the new tools of banking .The mobile phone will become the virtual ATM. It will perform the same role as credit and debit cards, avoiding the need for too many cash payments. In all probability, ATM expansion may slow down in cities and focus on remote villages or towns. Thus, together the payments banks can easily double the base of banking customers.

- E-commerce is another big opportunity for these banks. This is because more and more customers are using digital wallets, which are faster and more secure, instead of punching card details every time they transact online. The $7.69 billion Indian e-commerce industry is expected to grow to $ 17.52 billion by 2017 and around 70% of the business is based on the cash-on-delivery model. This may change in future after the entrance of Payment Banks. Many new payment banks are keen to tie up with universal banks and vice versa. Similarly, small finance banks, whose expertise is community banking, will scale up their model with the advantage of low-cost funds . Their emergence can be seen as an opportunity for bigger banks to penetrate more deeply into the rural market since payments banks are allowed to function as business correspondents (BC) too. For instance, Reliance Industries (RIL) entered into a partnership with State Bank of India (SBI), for a payments bank licence. RIL and SBI, in a first-of-its-kind public-private partnership, have joined on a mission to make India’s financial services digitally smart. SBI’s vast experience in structuring financial products for different customer segments will be combined with the digital access provided by RIL in completing the most efficient, simple and affordable delivery model with utmost focus on financial inclusion.

- With the vibrant, innovating, efficient and secured payment eco system in the country, the share of electronic payments is continuously on the increase, both in volume and value terms. Several payment channels viz., cards (including credit, debit and prepaid varieties), near field and card-less, electronic, internet and mobile based, are growing in big proportions. ATMs and POS machines have proliferated. The total payment system indicators as of March 2015 (excluding mobile banking ) in terms of volume and amount of which usage at ATM and POS is given hereunder ( Table -1)

Table-1 Payment system Indicators

| Year 2015 | Total(excluding mobile banking) | Usage at ATM | Usage at POS | Mobile banking |

| Volume – Nos.Billion | 11.7 | 7 | 1.42 | 0.17 |

| Amount – Rs.Trillion | 1682 | 22.52 | 3.11 | 1.04 |

(Source –RBI)

The remittances in the year 2014 accounts for $70 billion, exceeding China’s remittances amount of $ 64 billion . There is a huge untapped potential and banking space for payment banks in remittances/ payments services .

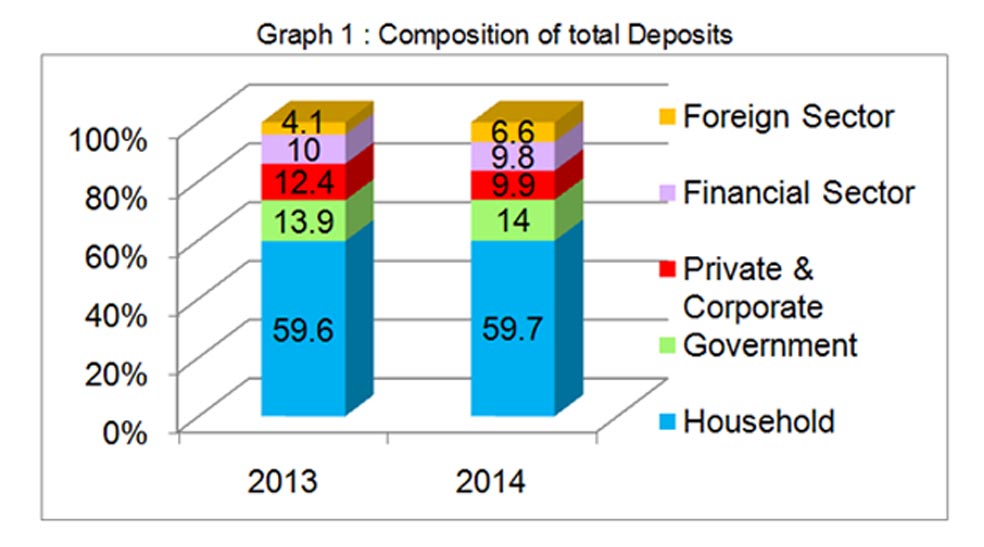

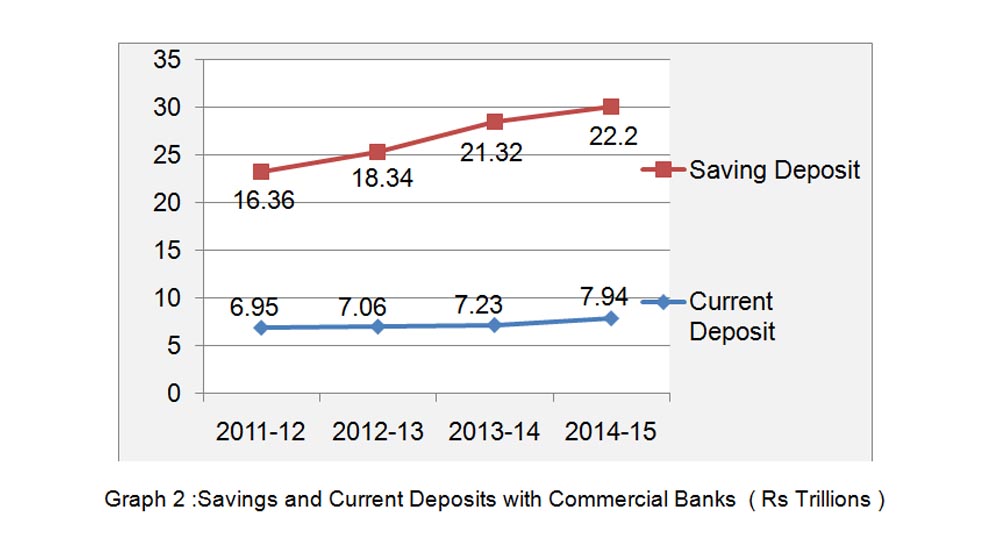

- The minimum paid-up equity capital for payments banks shall be Rs. 100 crore and the bank’s outside liabilities should not exceed 33.33 times its net worth (paid-up capital and reserves).Thus the payment bank is permitted to go up to deposit business of Rs. 3333 crores with 100 crores capital. Out of the total commercial banks deposit of Rs. 85.33 trillion as of March 2015, Current deposit and saving deposit constitutes about 10 % and 26 % respectively . Of the total deposits , deposits from Household accounts for 59.7 % (Graph-1) .

The total CASA as of March 2015 is Rs 30.14 trillion( Graph -2). Looking in to the present unbanked population potential , payments banks can play major role and reach out the household people for deposits business .

Challenges

- The basic tenets for a successful payment bank will be “high quality –low cost of delivery “, regular education /incentive and encourage its customers to do cash-less transactions and a robust technological frame work. Essentially the cost of transactions, for a payment bank, needs to be significantly lower of a traditional branch-based banking model. As payment bank can not lend and the major income is from government securities they will keep with expected return of about only 7 %, they have to charge its customers for the transactions that are executed through them. As low –income households , who are main targets of these Payments Banks may not accept the charges. However , competition can dramatically reduce transaction costs over a period of time. This will be volume based business . The Banks may have to invest extensively in technology so that all transactions go throw seamlessly and at lower cost

- Given the reasonable quality of India’s informal payment solutions and preference for cash, Payments Banks may find it difficult to drive customers into digital accounts by offering payment services alone. Though a few e-wallet players and online marketplace providers like Paytm & Foodpanda have made their entry into urban centres, these new banks may face greater difficulties in breaking into the rural market. They will need a conducive ecosystem and policy support. Large-scale migration of Indian customers over to Payments Bank accounts will require a more complete offering, including savings and credit services. Because Payments Banks cannot offer credit on their own, this will require partnerships with credit-issuing banks.

- Apart from amounts to be maintained as CRR, Payment banks have to keep minimum 75 % of its “demand deposit balances” in Statutory Liquidity Ratio(SLR),in eligible Government securities/treasury bills with maturity up to one year .As if the only possible solution to ensure complete safety of the funds , all deposits and float will actually be captured by the government. As it is, the (SLR) imposed on these banks is a form of financial repression and it is a challenge to thrive for them.

RBI’s licensing guidelines for Small Finance Banks (SFBs)

Objectives:

The objectives of setting up of small finance banks will be to further financial inclusion by (a) provision of savings vehicles, and (ii) supply of credit to small business units; small and marginal farmers; micro and small industries; and other unorganised sector entities, through high technology-low cost operations.

Eligible promoters:

Resident individuals/professionals with 10 years of experience in banking and finance; and companies and societies owned and controlled by residents will be eligible to set up small finance banks. Existing Non-Banking Finance Companies (NBFCs), Micro Finance Institutions (MFIs), and Local Area Banks (LABs) that are owned and controlled by residents can also opt for conversion into small finance banks. Promoter/promoter groups should be ‘fit and proper’ with a sound track record of professional experience or of running their businesses for at least a period of five years in order to be eligible to promote small finance banks.

Scope of activities :

1)The small finance bank shall primarily undertake basic banking activities of acceptance of deposits and lending to unserved and underserved sections including small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

2)There will not be any restriction in the area of operations of small finance banks.

Capital requirement:

The minimum paid-up equity capital for small finance banks shall be Rs. 100 crore.

Promoter’s contribution:

The promoter’s minimum initial contribution to the paid-up equity capital of such small finance bank shall at least be 40 per cent and gradually brought down to 26 per cent within 12 years from the date of commencement of business of the bank.

Foreign shareholding:

The foreign shareholding in the small finance bank would be as per the Foreign Direct Investment (FDI) policy for private sector banks as amended from time to time.

Prudential norms :

1)The small finance bank will be subject to all prudential norms and regulations of RBI as applicable to existing commercial banks including requirement of maintenance of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR). No forbearance would be provided for complying with the statutory provisions.

2)The small finance banks will be required to extend 75 per cent of its Adjusted Net Bank Credit (ANBC) to the sectors eligible for classification as priority sector lending (PSL) .

3)At least 50 per cent of its loan portfolio should constitute loans and advances of up to Rs. 25 lakh.

Transition path:

1)If the small finance bank aspires to transit into a universal bank, such transition will not be automatic, but would be subject to fulfilling minimum paid-up capital / net worth requirement as applicable to universal banks; its satisfactory track record of performance as a small finance bank and the outcome of the Reserve Bank’s due diligence exercise.

Small Finance Bank’s Role -Opportunities and Challenges

In the absence of desired results from Regional Rural Banks ( RRBs) in reaching the unserved and underserved mass , the small finance bank (SFBs), in furtherance of the objectives for which it is set up, shall primarily undertake basic banking activities of acceptance of deposits and lending to unserved and underserved sections including small business units, small and marginal farmers, micro and small industries and unorganised sector entities. SFBs can also provide remittance services, which will further increase the competition in the sector to which payments banks are also recent entrants. The SFBs can also distribute simple financial products, including insurance, mutual funds and pension products and one can expect further spread of these financial products. SFBs will have an opportunity for vertical penetration with an expanded range of products, unlike the NBF-MFIs that expand horizontally with limited number of products. This will also allow SFBs to create a judicious mix of high and low value customers, thus strengthening the business case.While there is significant market potential and opportunities for NBFC-MFIs turned SFBs they have to be cognisant of the costs associated with the transformation, and the challenges and risks that it presents.

Opportunities and Role

- RBI has granted “in-principle” approval to 10 applicants to set up small finance banks under the “Guidelines for Licensing of Small Finance Banks in the private sector” (Guidelines) issued on November 27, 2014. Eight out of the ten institutions who have been granted provisional licenses are Micro Financial Institutions (MFIs) that have a track record of providing scalable microcredit services. RBI, apart from considering parameters such as financial soundness, proposed business plan, and fit and proper status, also reflected on the ability of the institutions to reach out to unserved and underserved segments. Also, licensee institutions cover a wide geographical spread – Equitas, ESAF, Ujjivan and Janalakshnmi in the south, Disha and Suryodya in the west, RGVN in the east, and Utkarsh in the north. Selection list indicates that there is tremendous opportunities for these NBFC-MFIs to transformation in to small finance banks .

- The existing banking system does not offer a value proposition for rural low-income segments. This obviously presents an opportunity for SFBs to leverage savings that are stored under a mattress and locked into informal savings clubs/similar mechanisms. SFB also has the advantage over Payments bank as they can lend to unserved and underserved sections including small business units, small and marginal farmers, micro and small industries and unorganised sector entities. There is vast scope to make and expand presence in unbanked villages with a population up to 9,999. Of the 597,608 villages in India, 592,927 have population up to 9,999. Of these, 268,454 villages (with a population greater than 2,000 persons) have theoretically been covered under financial inclusion plan of the government and have branches (regular or ultra-small), or business correspondents and their agents. This leaves 324,473 villages outside the formal finance landscape and with suitable products, credible marketing and a strong distribution channel, rural markets do indeed have huge potential. NBFC-MFIs turned SFBs have significantly higher outreach in these areas than the banks. Through few tactics i.e designing and marketing of long-term, illiquid savings products during the harvest season and provision of highly liquid savings accounts during planting/weeding seasons, SFBs can penetrate deeply in the rural markets. The role of MFIs is significant in providing ‘the last mile’ banking services to the unbanked people by deploying over 0.195 million Business Correspondents / Customer Service Points (BC/CSPs). Therefore ,MFI turned SFBs will not only occupy the banking space , but also exhort commercial banks for efficient services .

- As convenience is the key to attracting savings, SFBs can create convenient avenues/touch points to trigger customers to save regularly. Fortnight/monthly group meetings are clearly a good place to source savings. Similarly, pigmy deposit has a lot of potential, which tries to capture surplus cash from households and businesses .This deposit scheme suits the needs of those having small and irregular cash flows such as the poor who could be daily wage earners, traders, housewives, etc. The bank’s roving authorised agents collect savings at clients’ doorsteps. Savers make deposits at regular intervals according to their convenience .But because of the Bank’s staffs reluctance, the banks have not focusing on this. The Payment Banks and Small Banks can play a leading role to fill the gap.

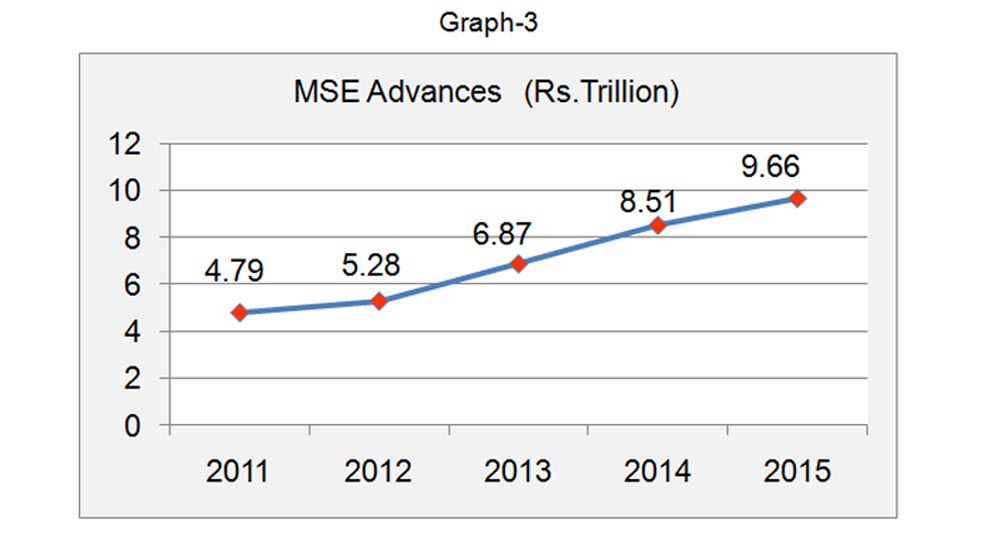

- NBFC-MFIs in India are based on a business model driven by credit. NBFC-MFIs are already known for its micro credit lending. With the existing credit base and proper risk management systems , restructuring of credit model , NBFC-MFIs turned SFBs can build further and expand credit lending . As per the Fourth Census of MSME sector, 5.18% of the units had availed of finance through institutional sources, 2.05% had finance from non-institutional sources and the majority of units i.e. 92.77%, had no finance or depended on self-finance. According to International Finance Corporation (IFC), Micro and Small Enterprise (MSE) sector faces severe financing shortage with debt shortfall of Rs 26 trillion. The actual lending by all Scheduled Commercial Banks to MSEs as of March 2015 is 9.66 trillion and though there is huge lending potential is untapped due to one or other reasons, the lending to MSE sector always shows increasing trend ( Graph-3) .

It is worth mentioning that NBFC-MFIs turned SFBs introduced the concept of financing to micro enterprises by adopting Joint Liability Group (JLG) mode ,which banks also started using for financing their small ticket borrowers. In the absence of alternate source of funding for the sector and looking in to the huge gap in lending , SFBs by reaching out to the vast number of micro and small enterprises can increase the lending under MSE sector and in turn contribute for economic growth. Further ,given their expertise and operation as MFIs, meeting the 75 percent priority sector lending(PSL) may not prove to be a challenge for these SFBs, nor will ensuring that half the book is to borrowers with less than Rs 25 lacs loans be .

Challenges

- Since the unbanked and underbanked population would be first-time users of formal financial services, it may be some time before they get familiarised with these. Further ,as the target customers for small finance banks are low-income households with certain degree of education and are not used to brick and mortar system, they prefer door-to-door services. So, it may not be easy to woo them and hence the way services are provided should be different from what universal banks. Further , SFBs will also face competition from Payment Banks under demand deposit portfolio . The SFBs probably may have to increase the deployment of BC/CSPs and their role .

- Hitherto ,MFIs turned SFBs rely on borrowing from other banks to grow. SFBs will now have to depend on their customers’ deposits and shareholders’ equity along with ‘refinance’ facilities from bulk lenders such as, NABARD , SIDBI and MUDRA Bank. Unlike credit which is a pull product, savings will see a gradual uptake, that too only if trust and ease of transaction are established upfront .The transformation will be an uphill task for SFBs as mobilising retail savings is extremely challenging. As MFIs, some players grew at almost 100 percent annually, but as they transition into a bank, they will have to face slow growth in the initial years as they grow their deposit base.

- Transformation to SFB entails changes in the business model, organisational structure, capital structure, product suite, IT/MIS, and others. These changes will lead to following challenges :

- High costs of transformation

- Capturing the rural mass amid higher trust enjoyed by commercial banks from the rural community, aggressiveness in enhancing their market share ,low cost of deposit mobilization

- SFBs may have to use innovative channels such as mobile money or card-based point-of-sales devices for which the infrastructure set up, channel management, and investment in financial education will all pose challenges.

- The regulation requires SFBs to ensure that a single shareholder holds a 40% stake in the organisation, and this must be reduced to 26% in 12 years. It will be a challenge for many MFIs turned SFBs as promoters of almost all large MFIs/NBFCs have a minority stake in the organisation.

- The guidelines require SFBs to ensure a capital adequacy ratio (CAR) of 15%, cash reserve ratio (CRR) of 4%, and statutory liquidity ratio (SLR) of 21.5 %. These will be a significant burden to manage, resulting in reduced earnings until SFBs develop a substantial depositor base.

- The guidelines put a cap of 74% foreign ownership in SFBs. Currently, many MFIs/NBFCs have more than 75% foreign equity due to investments from foreign sources. Bringing the figure to below 74% will be a challenge for these institutions considering the dearth of domestic equity sources.

- NBFC-MFIs are experienced in offering generic group lending products whereas banking would require them to enhance the product suite by adding other credit products such as micro and small enterprise finance, term deposit and savings products. SFBs can also be part of clearing system either as a direct member or through the sub-member route. The inexperience of NBFC-MFIs turned SFBs in offering such products will result in a period of learning before they can stabilise their product suite, its sales proposition, mix and channel. It will require a lot more effort to establish the brand as a full-service bank that is trustworthy as a custodian of precious savings.

Concluding Remarks

The banking landscape in our country is going through unprecedented changes and challenges. No doubt , the payment banks and small finance banks will create revolutionary storm in the Indian banking systems. It is expected that the new entities will bring in scale, technology and expertise incremental to the existing institutions in banking and therefore, the landscape would change dramatically in the future. The entry of MFIs in the small finance bank segment is a revolutionary step since these entities are well familiar with nuance of banking with the poor borrowers . After a series of setbacks –like the recent with drawl of three “in- principle” licence holders , eventually leaving only eight in the fray –the concept of payment banks seems to be finally inching closer to reality. Payment banks will bridge the last mile between bank branches and the remote customer living in a rural hamlet .Banking costs will come down due to intense competition driven by the expected proliferation of these banks The arrival of these banks will transform social welfare and subsidy scheme. Mobile banking will create the conditions for cash-less banking .ATM expansion may be slowed down in cities and may be focused on distant villages or towns .

The threat of impending competition from differentiated banks has awakened incumbent banks to look at liabilities and payments as a separate business and not just as a source of liquidity and facilitating transactions. The focus of the banks is shifting from the stock of balances in accounts to the flow and velocity of payments by customers. In the past six months many large banks have launched a slew of payments-focused apps and services. With new kinds of entities in the financial sector, active collaborations are seen between banks. Many incumbent banks have already announced tie-ups with the new payments banks. Hitherto financial inclusion was a compliance requirement to fulfill government mandate and social agenda, and would typically get relegated to a stand-alone department in the bank trying its best to do what was possible. This has now changed and sustainable business strategies with latest innovations in technology are being debated, presented and implemented. Reaching out to untapped segments in rural areas and small towns, by using new business models is now considered the next big opportunity for the financial sector and are actively engaging in it.

The revolution of Indian banking has begun and not only the common masses would be the biggest beneficiary of this, the government will also one of the biggest beneficiaries , as these banks will expand its access to cheap funds. Bank depositors can expect to earn higher short term deposit rates and the old 4 % savings bank norm probably fade away. These niche and differentiated banks will make financial inclusion more complete from the small borrower’s point of view. Payments banks and SFBs will make Indian banking more competitive and more inclusive on both the assets and liabilities sides, i.e for both small depositors and borrowers , thus making banking more affordable and reachable for the common man.

References

1)RBI Guidelines for Licensing of Small Finance Banks in the Private Sector Dated Nov 17,2014

2)RBI Guidelines for Licensing of Payments Banks dated Nov 17, 2014

3)RBI grants “In-principle” Approval to 10 Applicants for Small Finance Banks dated September 16,2015

4) RBI grants “in-principle” approval to 11 Applicants for Payments Banks dated August 19,2015

5) RBI Bulletin – Composition and Ownership Pattern of Deposits with Scheduled Commercial Banks: March 2014 dated March 10, 2015

6) RBI Bulletin –Payment system Indicators dated December 10,2015

7) RBI – Handbook of Statistics on Indian Economy

About the Author

M.Ramamoorthy

BE( Mechanical), CAIIB , MBA ( Banking & Finance ) , F.I.V Senior Manager ( Faculty)

- 5 Years working experience in Industry before Joining the Bank in 1986

- Approved Valuer for Machinery & Plant

- Corporate life Member (Fellow ) -Institution of Valuers , New Delhi

- Banking Articles on current topic are published in the magazine of “Vinimaya ( NIBM)”, “Banking Finance” and “The Indian Banker ( IBA)”