Bad Bank: Is the buzz over ?

Buzz about bad bank:

In the last few years, the banking industry has been abuzz with the news of a bad bank in the making. It was a point of discussion in the informal (sometimes formal also) channels of communication among those who take keen interest in banking related news. The reason is that it seemed to be the quick fix solution to those (cynics) who did not believe in any effective innovative solution. In any case, that grapevine is nowhere to see now, as the Government has come up with a scheme named “Sashakt” and has categorically stated that the scheme does not envisage any bad bank. Thus, they have put a full stop on that point of discussion and in turn, on the mouths of the cynics also.

NPAs of Banking Sector:

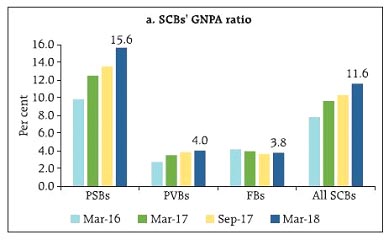

As per RBI’s Financial Stability Report of June 2018, the stress in the banking sector continues as gross non-performing advances (GNPA) ratio rises further. SCBs’ gross non-performing advances (GNPA) ratio rose from 10.2 per cent in September 2017 to 11.6 per cent in March 2018. This can be gone through elaborately from the following chart derived from the abovementioned RBI Report.

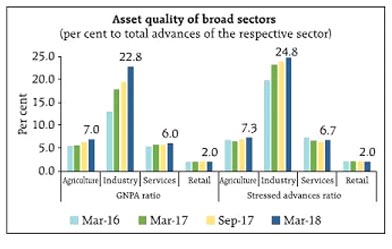

Not only gross NPAs increased, but also each broad sector registered an increase, which can be verified from the following chart derived from the same report of RBI. It indicates that none of the broad sectors showed signs of recovery.

Impact of high NPAs on provisioning and profitability:

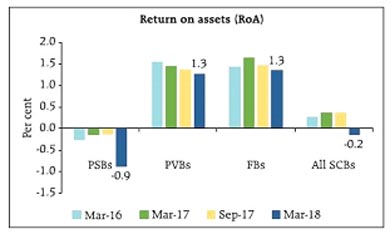

Increased NPAs lead to higher provision and higher provisions take toll on profits. An outcome of high provisions is that all bank types viz. Public Sector Banks (PSBs), Private Sector Banks (PvBs) and Foreign Banks (FBs) registered a high PCR (Provision Coverage Ratio) in March 2018. Thus, profitability of scheduled commercial banks (SCBs) declined sharply in FY18. In fact, many banks showed losses for the year 2017-18. As a by-product of losses / poor profitability, Return on Assets (RoA) also registered a sharp decline YoY. Following is an excerpt of RoA, extracted from RBI’s Financial Stability Report.

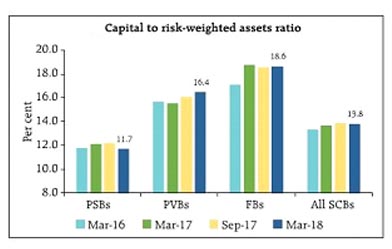

Losses erode capital. So, this has added pressure on SCBs’ regulatory capital ratios. Their capital to risk-weighted assets ratio (CRAR) declined marginally between September 2017 and March 2018, which can be observed from the following chart derived from the above mentioned report of RBI.

Future projection of NPAs:

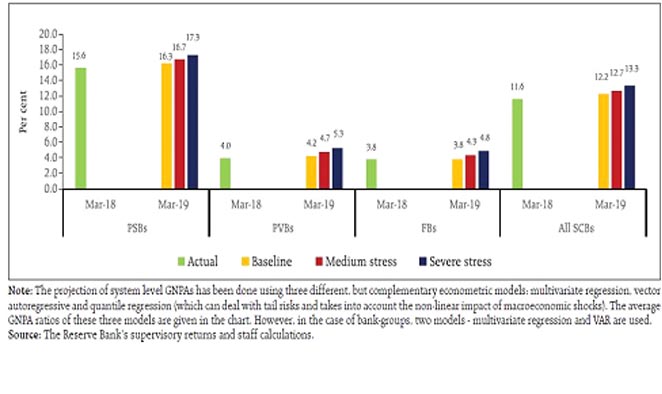

It is frightening to know that projections of future NPA present an even grimmer picture. As per RBI’s Financial Stability Report of June 2018, “The stress tests indicate that under the baseline scenario, the GNPA ratio of all SCBs may increase from 11.6 percent in March 2018 to 12.2 percent by March 2019. However, if the macro economic conditions deteriorate, their GNPA ratio may increase further under such consequential stress scenarios. Among the bank groups, PSBs’ GNPA ratio may increase from 15.6 percent in March 2018 to 17.3 percent by March 2019 under severe stress scenario, whereas PvBs’ GNPA ratio may rise from 4.0 percent to 5.3 percent and FBs’ GNPA ratio might increase from 3.8 percent to 4.8 percent”.

Projection of SCBs’ GNPA ratios

(under various scenarios)

Evolution of ‘Sashakt’:

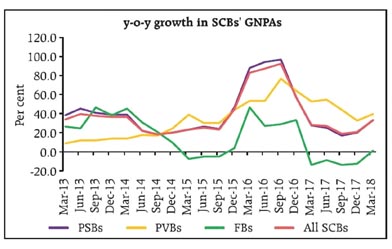

Following chart derived from RBI Data, shows that since March 2013, all types of banks viz. PSBs, PvBs, FBs (with only exception of FBs / Foreign banks in a few quarters), have registered year on year ‘only’ increase in each quarter continuously. In case of Private Sector Banks (PvBs), the y-o-y increase itself shows an accelerating trend till Sep 2016.

Problem of NPAs is not new. To grapple with the problem, the Government, from time to time, came up with necessary ways and means. As a result of this, Banking industry witnessed in the past a few new tools viz. DRT, SARFAESI, IBC etc.

Despite all these efforts, problem of NPAs only grew, as discussed in the above chart. It seemed that “All the tools of NPA resolution will not sweeten this little advance.” (plagiarizing from Shakespeare’s “All the perfumes of Arabia will not sweeten this little hand”).

As a new strategy, the Government formed in early June 2018,a bankers’ panel, headed by Mr Sunil Mehta, Chairman of Punjab National Bank to come up with a solution to the problem of high value NPAs. After a lot of brain storming, the committee came up with a scheme, which they named ‘Sashakt’.

Key Points of the Scheme:

The key points of the scheme, as derived from the press conference held by Mr Piyush Goyal, Interim Finance Minister, on 03.07.2018 are following:

For assets under Rs 50 crores (exposure involved Rs 2.1 crs):

- A resolution plan will be arrived at within 90 days of detection of stress by individual banks.

- Templated resolution approaches recommended for different types of assets

- Resolution for such loans should be non-discretionary, nondiscriminatory and completed in a time bound manner i.e. 90 days

For assets between Rs 50-500 crores (exposure involved Rs 3.1 crs):

- The lead lender should take charge and devise a resolution plan within 180 days.

- The lead lender will be helped by large banks, if required.

- Financial institutions will enter into an Inter Creditor Agreement to authorize the lead bank to implement a resolution plan in 180 days. The agreement is the bedrock of the bank-led resolution approach (BLRA) for loans between Rs 50-500 crores. This inter-creditor agreement will be a legal document and enforceable in any court of law.

- The resolution plan should be approved by lenders holding at least 66% debt

For assets worth over Rs 500 crores (exposure involved Rs 3.1 crs):

- An AMC structure will be created.

- Multiple AMCs are likely to be created.

- AMC to be formed with equity infusion from banks, foreign funds, infrastructure investment funds.

- Alternative investment funds (AIF) will be created by institutional investors.

- AIFs will fund AMCs to buy stressed assets from the banking sector.

- Banks may also invest in AIFs to tap into upside on the asset later.

- AMCs will appoint industry experts and ‘turnaround specialists’ to help resolve the stressed asset.

- ARC will issue security receipts which will be subscribed by the AIFs.

- Thus, funds received from AIFs will be utilized by ARCs to repay banks.

- ARCs will repay security receipts in full within 60 days to Bank.

- ARCs will also be allowed to bid for assets through a transparent auction process.

- ARCs could also tie up with AMCs to operate and turnaround the asset.

- Banks may also push for creation of a platform for trading assets.

Problems ahead:

Though the panel has strived hard to come up with a good solution, cynics have their own doubts, which may be alleviated only over a period of time, depending on the success of the scheme. Following are a few points which are worth noting.

- One of the major problems in the existing tool i.e. IBC, was to find investors (with sufficient funds and intention), who could invest in stressed assets. The premise of this new scheme is also that AIFs will be created. The question is whether we will get suitable investors to fund the AIFs.

- Banks were always inclined on the turnaround of the stressed assets. ARCs were also working on the same. The new scheme envisages that AMC will conduct operational turnaround of the asset by itself or by engaging an external expert. It is yet to be seen what difference the new pattern will be able to bring forth.

- The main problem earlier was that banks always wanted a better price of the asset, while ARCs wanted to buy at throw away prices. In the new scheme, creation of a trading platform has been suggested. But that trading will come into picture only after asset has been sold to ARC. Thus, the problem of price haggling remains same.

- The panel estimated that public sector lenders will need Rs 1.1 – 1.3 lakh crores over a two-year period to deal with resolution of ailing companies. While the Government will provide Rs 65000 crores, the remaining amount is to be arranged by banks. Banks are already facing capital crunch. As such, the way out for them is to sell off non-core assets. Another option for them is to raise equity, which is also not an easy task, given the scenario of losses / poor profitability.

- It has been stated in the scheme that banks may also invest to participate in the upside. If bank can expect the upside, why should it hasten to sell the asset at a discount in the first place?

- Banks want to get rid of their stressed and non-productive assets. AIFs are supposed to buy these assets. But AIFs will be funded partly by banks also. Thus, banks, even after disposing of an asset, remain joint owner through AIF. Isn’t it a situation like Bollywood song “Juda ho ke bhi, tu mujhmein kahin baaki hai” (even after separation, a little of you is still in me)?

Whether the new scheme ‘Sashakt’ will be able to wade through the murky waters of NPA or not, time will tell. For now, one thing is sure that idea of a bad bank has been put to the back burner;Rather it has been ruled out altogether. Success or failure, Banking industry is pinning its hopes on this new scheme.

Abbreviations Used:

| AIF: Alternative investment funds |

| AMC: Asset Management company |

| FBs: Foreign Banks |

| GDP: Gross Domestic Product |

| GNPA: Gross Non-Performing Assets |

| IBC: Insolvency and Bankruptcy Code |

| NCD: Non-Convertible Debentures |

| NIM: Net Interest Margin |

| NNPA: Net Non-Performing Assets |

| PSBs: Public Sector Banks |

| PvBs: Private sector Banks |

| SCBs: Scheduled Commercial Banks |

| y-o-y: Year on Year |

References:

RBI’s Financial Stability Report of June 2018

RBI’s supervisory returns

Bloomberg Quint website

Business Standard website

Economic Times website

Author

Sanjay Gupta

Chief Manager (Research), State Bank Institute of Credit

and Risk Management (SBICRM), (Earlier name: State Bank Academy), Gurugram

Published : Banking Finance, November 2018