Artificial Intelligence in Banking Sector

In the traditional banking, the core objective was to perform the basic functions such as depository institutions, maintain deposits, make loans, and control the check-able deposits portion of the economy’s money. Now with modern banking system and advent of technologies, loads of services are being rendered which were either not there in traditional banking) or getting fulfilled unsatisfactorily.

The unprecedented change in technology is revolutionizing the banking system in term of operational productivity and quality of customer service which is very much dependent on the three fundamental pillars – People, Process and Technology.

People – People are the custodians of the digital revolution. They values the customer relationship, they examine the process, they know the know how. Involving the right set of people in technology implementation can yield the best desired output. Technology needs human and power to success lies in training employees to utilise the technology at its best.

Process: It involves automating various processes within the banking sector to achieve agile phenomena, improved efficiency and better customer satisfaction. Apart from various technologies like mobility, self banking etc. which are already in place, ARTIFICIAL INTELLIGENCE (AI) is pushing the boundaries towards extensive automation.

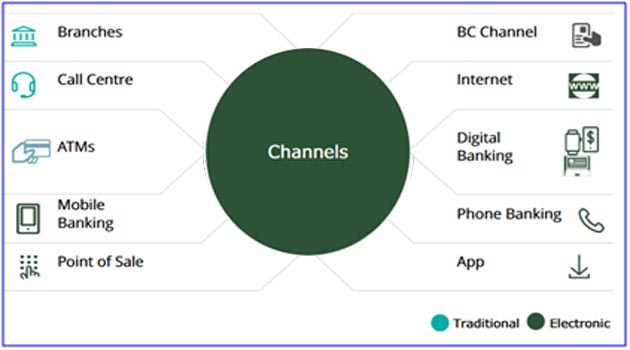

Technology– Last two decade saw a massive changes in banking sector due to adoption of Information communication and technology (ICT). Banks started introducing technology in banking or order to streamline the processes and better customer experience. Few of the key milestones were:

- Manual Banking to ALPM

- ALPM to centralized banking solution

- Lending Automation Solutions

- Different Packages for work like Pensions, Tax Collections etc

- Different SMS Services

- E lobby and different Transactions machines like ATMs,Cash deposit machine, Passbook printing machine.

- Introduction of Call Centers

- Different apps of view and transaction activity

- Online account opening, Loan application etc.

The impact is very significant. Technology-intensive solutions has led to increase revenue, enhance customer experience, optimize cost structure and manage enterprise risk.

Artificial Intelligence

With increased transactions, wide services offering and fathoms of data getting generated everyday key is to utilize these data at right time which makes continuous technology upgrade imperative. Artificial Intelligence is one such area which has taken Banking industry by storm lately.

Wikipedia definition: Artificial intelligence (AI, also machine intelligence, MI) is intelligence displayed by machines, in contrast with the natural intelligence (NI) displayed by humans and other animals.

At the heart of the AI revolution are machine learning algorithms, software that self-improves as it is fed more and more data, a trend that the financial industry can benefit from immensely.

Scope of AI in Banking sector

With the proliferation of data, the ability to effectively leverage insight and improve customer satisfaction is huge using Artificial Intelligence. Few of the use cases are:

Process Automation: High degree of manual processing is costly and it can lead to inconsistent result and errors. Various processes within bank can be fully automated and some can be modified with lean human intervention depending on complexity of the process. For example; one of the leading bank in US determined that 85 percent of its operations, accounting for 80 percent of the current full-time employees (FTEs), could—theoretically—be at least partially automated. At the time of this analysis, fewer than 50 percent of these processes were automated at all. If an ideal level of automation were reached, then almost 50 percent of the FTEs in operations could be relieved of their current back-office tasks.

Enhanced customer support: Chatbots backed by AI and integrated with banks existing digital solution can help in responding to customer queries faster and effectively. With all the learning about the bank’s process, schemes, offering, etc. chatbot can be utilised to response with pre-programmed questions or information to help guide the customer to a solution and can be available 24X7.

ICICI Bank launched its AI-based chatbot. Since its launch, the chatbot has interacted with 3.1 million customers, answering about 6 million queries, with a 90 percent accuracy rate.

Predictive Analysis: When customers are interacting with their financial institution through multiple channels, the explosion in consumer data can help banks and credit unions generate key insights that can respond to new market trends and changing consumer behaviors. This can help organizations create better products and personalized experiences which can increase revenues and decrease costs.

Conclusion

To stay ahead of technology curve, financial organisations are willing to take holistic approach to reap benefits of Artificial Intelligence. This is definitely going to be an endless and continuous learning activity and moving beyond ‘Automation of process’ to bring in ‘Intelligence factor’ is going to be the key to get the optimal output. Various banks have already started implementing variety of AI applications including chatbots, risk monitoring, training, etc. however, this is just the beginning. Strategic steps by step approach can help to maximum advantage. Few steps we suggest are:

- leverage AI to bring invisible and WOW for customer

- Integrate with other technologies present in the banking ecosystem to bring seamless customer centric approach

- Automate high volume and low complexity task to increase workforce efficiency.

Author : NAVNIT KUMAR

SENIOR MANAGER(FACULTY)

STAFF TRAINING CENTRE,BHUBANESWAR

Source

https://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/automating-the-banks-back-office

https://www.techemergence.com/ai-applications-in-the-top-4-indian-banks/

Disclaimer: Information from various public sources have been utilized while writing this article.